发布时间:2016-03-09 作者: 罗思义

中国经济崛起对世界具有双重意义:首先是实践意义,中国经济增长规模对全球造成积极影响,改善了中国和世界人口的社会状况;其次是理论意义,中国的经济学理论应在世界经济学理论中占有一席之地,值得世界上许多别的国家借鉴。

Online Appendix 3 - Deng Xiaoping and John Maynard Keynes

在线技术附录 3 -邓小平与约翰·梅纳德·凯恩斯

Introduction

序言

The international importance of China`s economy is twofold. The first is practical - the scale of China`s economic growth, its global impact, and the consequences for the improvement of the social conditions of China and the world`s population. The second is theoretical.

中国经济崛起对世界具有双重意义:首先是实践意义,中国经济增长规模对全球造成积极影响,改善了中国和世界人口的社会状况;其次是理论意义,中国的经济学理论应在世界经济学理论中占有一席之地,值得世界上许多别的国家借鉴。

China and macro-economic theory

中国与宏观经济理论

China`s `reform and opening up` process under Deng Xiaoping was, of course, formulated in a Marxist economic framework. It can be clearly and succinctly outlined in those terms - seeOnline Appendix 2 Marxist Analysis of China`s Economic Reform. However, as will be shown here, it is not necessary to be a Marxist to understand China`s economic policy. An alternative statement in Western economic terms, those of Keynes, is given in this appendix.

在邓小平的领导下,中国改革开放进程的构想与马克思主义经济学框架一脉相承。中国经济政策中的一些措辞也明显源自马克思主义术语,相关内容请见在线技术附录2的"从马克思主义角度分析中国经济改革"。不过,如下文所示,不一定要从马克思主义角度才能读懂中国经济政策,我们还可以从西方经济学的另一个角度--凯恩斯经济学角度解读中国经济政策。

Stated briefly in Marxist terms, China`s reform policy included a critique of Soviet economic policy that this had made the error of confusing the `advanced` stage of socialism/communism, in which the regulation of the economy is `for need`, and therefore not market regulated, with the socialist, or more precisely `primary` developing stage of socialism, during which the transition from capitalism to an advanced socialist economy takes place and in which market regulation takes place. This transition should be conceived as extending over a prolonged period. The final formulation arrived at was that China`s was a `socialist market economy with Chinese characteristics`. Contrary to suggestions by some writers, for example (Hsu, 1991), such an analysis is in line with Marx`s own writings, as analysed in Online Appendix 2 Marxist Analysis of China`s Economic Reform.

中国的改革政策包括批判了苏联的经济政策,用马克思主义术语来说,苏联的错误在于混淆了社会主义/共产主义的高级阶段,在社会主义阶段或者更确切地说社会主义初级发展阶段就用"按需分配"而非"市场调节"手段调控经济,而从资本主义到社会主义高级阶段的过渡时期,调控经济的手段应顺应市场,而且这种过渡是一个长期过程。中国最后建立了"中国特色社会主义市场经济"体系。正如在线附录2的"从马克思主义角度分析中国经济改革"所分析的,与罗伯特·徐等一些作者的看法相反,中国的经济政策框架与马克思主义一致。

China`s analysis was framed in Chinese terms, without primary reference to economic theory in other countries except for Marx himself. The approach emphasised by Deng, was to `seek truth from facts` (Deng, 2 June 1978). In practical terms in China, such analysis meant abandonment of an administratively planned economy and substitution of a market economy in which the state would control certain key macroeconomic parameters. In terms of ownership it led to `ZhuadaFangxiao` - maintaining large state firms and releasing small ones to the non-state/private sector.

中国制定经济政策时是以中国自己的经济理论为依据,除了马克思之外,并没有优先参考其他国家的经济理论。用邓小平的话来讲就是实事求是。从实践意义来看,这种政策意味着抛弃计划经济,用市场经济取而代之,与此同时政府会控制某些关键的宏观经济指标。另外,中国在所有制方面则采取了"抓大放小"政策--即保留大型国有企业为国有制,放活小型国有企业为非国有/私有制。

Restatement of Chinese economic policy in terms of Keynesian economics

从凯恩斯经济学角度解读中国经济政策

Most people in the US and Europe, however, are unaware of Marxist economic categories. To make the essential economic policies clear, therefore, this article will put them in terms of Western economics - those of Keynes. The proviso is that this is the actual Keynes of The General Theory of Employment Interest and Money - not the vulgarised version in economics textbooks. There is no substitute in this regard for reading Keynes General Theory itself, which differs sharply from the presentation of what is frequently presented as `Keynesian` economics. For example, budget deficits play only a secondary role in Keynes General Theory. A short summary of Keynes analysis was given in Chapter 17 and a more comprehensive one is given here.

在线技术附录2已从马克思主义角度分析过中国经济改革,为便于读者更全面地了解中国经济政策,本附录将从属西方经济学流派的凯恩斯经济学角度来解读中国经济政策。本节主要引用的参考文献是凯恩斯亲作《就业、利息和货币通论》(The General Theory of Employment Interest and Money》,而非经其他作者之手改动过的经济学教科书版本。如果大家想更多地了解凯恩斯,建议大家最好拜读凯恩斯的《通论》,因为它与频繁在媒体上出现的"凯恩斯经济学"有很大的出入。比如,凯恩斯在《通论》中指出,预算赤字仅能发挥次要作用。第十七章曾对凯恩斯经济理论作了简短总结,更全面的分析则在本附录。

The rising proportion of the economy devoted to investment

投资占经济比重呈不断上升趋势

In the founding work of classical economics, The Wealth of Nations, Adam Smith identified division of labour as the fundamental force raising productivity, stating as the opening sentence of the first chapter: `The greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgement with which it is any where directed, or applied, seems to have been the effects of the division of labour.` (Smith, 1776, p. 13) Smith concluded that a necessary consequence of the increasing division of labour was that the proportion of the economy devoted to investment rose with economic development: `accumulation of stock must, in the nature of things, be previous to the division of labour, so labour can be more and more subdivided in proportion only as stock is previously more and more accumulated… As the division of labour advances, therefore, in order to give constant employment to an equal number of workmen, an equal stock of provisions, and a greater stock of materials and tools than what would have been necessary in a ruder state of things must be accumulated beforehand.` (Smith, 1776, p. 277) A more comprehensive treatment of Smith`s views may be found in Online Appendix 1 Adam Smith`s Theory of Economic Growth. Marx reached the same conclusion as Smith, concluding that the contribution of investment rose as an economy developed, which he termed the rising `organic composition of capital` (Marx, 1867, p. 762).

古典经济学的开山之作当属亚当·斯密的《国富论》,他在此书中指出,劳工分工是提高生产力的最重要因素,并在第一章开头一句话称:"劳动生产力最为重大的进步,以及人们不管往何处引导或在何种应用劳动生产力,所展现的大部分技巧、熟练度与判断力,似乎都是劳动分工的结果。"(斯密,1776年,《国富论》,第13页)。斯密得出结论,投资占经济比重随经济发展呈上升趋势是劳动分工逐步细化的必然结果:"按道理来说,各种物品的积累必然先于社会分工。所以,只有当事先积累的各种物品数量愈来愈多时,劳动分工才可能分得愈来愈细腻……因此,当劳动分工愈来愈细腻时,若要让相同数目的工人经常进行工作,除了必须有相同数量的食物积蓄事先积累起来之外,事先积累的原料和工具数量,也必须比劳动分工粗略时还要多一些。"(斯密,1776年,《国富论》,第277页)。关于斯密的更全面的分析请见附录1的"亚当·斯密的经济增长理论"。马克思也得出和斯密一样的结论,即投资对经济增长的贡献率随经济发展呈上升趋势,他称之为"资本有机构成呈不断上升趋势"。(马克思,1867年,《资本论》,第 762页)

Keynes similarly analysed that the proportion of the economy devoted to investment rose with economic development. His explanation was, however, somewhat different to Smith`s as Keynes rooted this in rising savings levels accompanying development. As the percentage of income consumed fell with increasing wealth, the proportion devoted to saving necessarily rose proportionately: `men are disposed… to increase their consumption as their income increases, but not by as much as the increase in their income… a higher absolute level of income will tend… to widen the gap between income and consumption.` (Keynes, 1936, p. 36) As total savings necessarily equals total investment, a rising proportion of saving therefore necessarily means a rising proportion of investment.

凯恩斯同样认为,投资占经济比重会随经济发展而上升。然而,他的解释与斯密有点不同,他认为,储蓄水平随经济发展会不断上升。因为随着财富的增加,消费占收入的比重会下降,储蓄占收入的比重则必然会上升:"当人们收入增加时,消费也增加,但消费的增加不如收入增加得快。较高的绝对收入水平,往往会扩大收入和消费之间的差距。"(凯恩斯,1936年,《就业、利息和货币通论》,第36页)。因为总储蓄必然等于总投资,因此,储蓄比重上升必然意味着投资比重上升。

Keynes noted a necessary consequence of an increase in the proportion of the economy devoted to investment is that any investment decline will have increasingly serious consequences: `the richer the community, the wider will tend to be the gap between its actual and its potential production… For a poor community will be prone to consume by far the greater part of its output, so that a very modest measure of investment will be sufficient to provide full employment; whereas a wealthy community will have to discover much ampler opportunities for investment if the saving propensities of its wealthier members are to be compatible with the employment of its poorer members. If in a potentially wealthy community the inducement to invest is weak… the working of the principle of effective demand will compel it to reduce its actual output, until, in spite of its potential wealth, it has become so poor that its surplus over its consumption is sufficiently diminished to correspond to the weakness of the inducement to invest.` (Keynes, 1936, p. 31)

凯恩斯指出,投资占经济比重呈上升趋势带来的必然结果是,投资下降所造成的负面影响会日益严重:"社会越富裕,其实际产出和潜在产出之间的差距越大……贫穷的社会往往会消费掉它的很大一部分的产量,所以数量非常有限的投资便会足以导致充分就业。反之,富裕的社会必须为投资提供更加充足的机会来导致充分就业,如果想使该社会的富人的储蓄倾向与该社会的穷人的就业不发生矛盾的话。如果在一个潜在富裕的社会中,投资动机微弱,那么尽管存在着潜在的财富,有效需求原理的作用会强迫该社会减少它的产量,一直到存在着潜在财富的该社会贫穷到如此的程度,以致它产量的多于其消费的部分被减少到与它的微弱的投资动机相适应时为止。"(凯恩斯,1936年,《就业、利息和货币通论》,第31页)

Failure of attempts to refute Keynes on the rising proportion of investment

试图批驳凯恩斯"投资占经济比重呈上升趋势"结论的人惨败

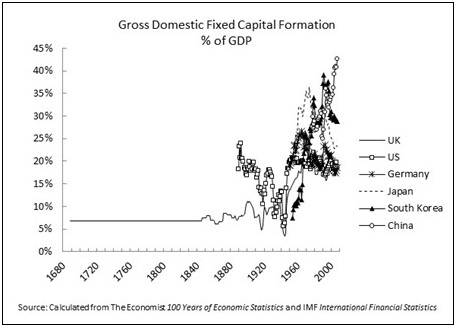

In the mid-20th century attempts were made to dispute this conclusion of classical economics, originally deriving from Smith, of a rising proportion of investment in the economy - Milton Friedman devoted a book, A Theory of the Consumption Function, to attempting to refute Keynes on this (Friedman, 1957). However modern econometric findings are conclusive in support of Smith and Keynes and against Friedman - the definitive demonstration, as frequently on matters of long term economic growth, being given by Angus Maddison. (Maddison, 1992) Factually, as classical economics and Keynes analysed, the trend is for the proportion of the economy devoted to investment to rise. To illustrate this, Figure 1 shows the percentage of fixed investment in GDP of the leading economies of successive periods of growth over the 300-year period for which meaningful statistics exist.

20世纪中期,曾有人试图推翻由斯密创立的古典经济学理论,米尔顿·弗里德曼(Milton Friedman )为此专门写了一本书《消费函数理论》(A Theory of the Consumption Function)》,试图反驳凯恩斯的源自斯密的"投资占经济比重呈不断上升趋势"的观点。(弗里德曼, 1957年,《消费函数理论》)。但现代计量经济学的研究结果显示,斯密和凯恩斯的观点是对的,弗里德曼的观点则是错误的--安格斯·麦迪森(Angus Maddison)对长期经济增长的长年研究果也明确验证了这一结论。(麦迪森,1992年,《从长期视角看储蓄》)。事实上,正如古典经济学和凯恩斯所分析的,投资占经济比重不断上升是一种趋势。为说明这一点,特附上主要经济体经济连续增长期间固定投资占GDP比重数据。为增强数据说服力,统计时间跨度长达300多年。

Figure 1

A reason Friedman attempted, unsuccessfully, to refute Keynes over the rising proportion of investment in the economy is that such a trend, as will be seen, is potentially destabilising - Friedman noted: `the central analytical proposition of the [theoretical] structure is the denial that the long-run equilibrium position of a free enterprise economy is necessarily at full employment.` (Friedman, 1957, p. 237)

弗里德曼未成功推翻凯恩斯的"投资占经济比重呈不断上升趋势"结论的原因在于他认为"这样的趋势具有潜在的不稳定性"。他指出:"[理论]结构的核心分析命题是否定自由企业经济的长期均衡状态必须保证经济处于充分就业状态。"(弗里德曼,1957,《消费职能理论》,第237页)

Effective demand

有效需求

Keynes approached economic fluctuations via profit: `The trade cycle is best regarded… as being occasioned by a cyclical change in the marginal efficiency of capital.` (Keynes, 1936, p. 313) Keynes specific development and contribution was to approach the potentially destabilising consequences of the rising proportion of investment in the economy via effective demand.

凯恩斯认为可通过增加利润解决经济波动:"经济周期最好应被当作系由资本边际效率的周期性变动所造成。"(凯恩斯,1936年,《就业、利息和货币通论》,第313页,中文第327页)。凯恩斯的具体贡献是他通过有效需求消除了投资占经济比重不断上升所带来的潜在不稳定性影响。

Effective demand is composed of both consumption and investment, with the latter, as noted, tending to rise relative to the former over time. Keynes therefore noted: `when aggregate real income is increased aggregate consumption is increased but not by as much as income… Thus to justify any given amount of employment there must be an amount of current investment sufficient to absorb the excess of total output over what the community chooses to consume when employment is at the given level… It follows… that given what we shall call the community`s propensity to consume, the equilibrium level of employment, i.e. the level at which there is no inducement to employers as a whole either to expand or to contract employment, will depend on the amount of current investment.` (Keynes, 1936, p. 27)

有效需求是由消费和投资两部分构成,值得注意的是,随着时间的推移,后者(投资)较前者(消费)会相对上升。因此,凯恩斯指出:"当实际收入总量增加时,总消费量也会增加,但增加的程度不如收入……这样,为了能维持既定的就业量,就必须要有足够数量的现期投资来补偿总产量多出在该就业量时社会所愿意消费的数量部分……因此,在既定的被我们称为消费倾向的条件下,就业量的均衡水平(即对全部企业家来说有没有动机促使他们扩大或减少就业量的水平)取决于现期的投资数量。"(凯恩斯,1936年,《就业、利息和货币通论》,第 27页,中文第33页)

Keynes noted no automatic mechanism ensures a necessary volume of investment to maintain effective demand: `the effective demand associated with full employment is a special case… It can only exist when, by accident or design, current investment provides an amount of demand just equal to the excess of the aggregate supply price of the output resulting from full employment over what the community will choose to spend on consumption when it is fully employed.` (Keynes, 1936, p. 28) Put aphoristically: `An act of individual saving means - so to speak - a decision not to have dinner today. But it does notnecessitate a decision to have dinner or buy a pair of boots a week hence or a year hence.` (Keynes, 1936, p. 210). In more technical terminology: `The error lies in proceeding to the … inference that, when an individual saves, he will increase aggregate investment by an equal amount.` (Keynes, 1936, p. 83)

凯恩斯指出,确保必要投资量以维持有效需求的自动调节机制是不存在的:"因为,与充分就业相对应的有效需求是一种特殊事例………然而,只有在偶然的场合或者通过人为的策划,使现期的投资量对需求所提供的数量正好等于充分就业所造成的产量的总供给价格大于社会在充分就业时所愿意有的消费量的部分。"(凯恩斯,1936年,《就业、利息和货币通论》,第 28页,中文第33页)简言之:"个人进行的储蓄行为--可以被说成是--今天不用餐的决策。但这一决策并不必然导致一星期或者一年以后用餐或者买双皮靴的决策。(凯恩斯,1936年,《就业、利息和货币通论》,第 210页,中文第218页)用更专业的术语来说,就是:"老式说法的错误在于根据个人的储蓄行为便作出似是而非的推断,认为也会使总投资增加相同的数量。"(凯恩斯,1936年,《就业、利息和货币通论》,第 83页,中文第91页)

Any investment shortfall would be amplified by the well known economic `multiplier` into much stronger cyclical fluctuations: `It is… to the general principle of the multiplier to which we have to look for an explanation of how fluctuations in the amount of investment, which are a comparatively small proportion of the national income, are capable of generating fluctuations in aggregate employment and income so much greater in amplitude than themselves.` (Keynes, 1936, p. 122) Such fluctuations in investment, combined with consumption, in turn determined employment: `The propensity to consume and the rate of new investment determine between them the volume of employment.` (Keynes, 1936, p. 30)

任何投资缺口都会被我们熟知的"乘数效应"放大,最终产生更大幅度的经济周期波动:"尽管如此,我们还是应该依靠乘数的一般原理来解释为什么占国民收入相对微小比重的投资的波动会造成总就业量和收入的波动,而波动的幅度远远超过投资波动本身。"(凯恩斯,1936年,《就业、利息和货币通论》,第 122页,中文第126页)。投资结合消费的这种波动,反过来会决定就业:消费倾向和新投资的数量二者在一起决定就业量。"(凯恩斯,1936年,《就业、利息和货币通论》,第 30页,中文第36页)

From this analysis Keynes derived key policy conclusions.

凯恩斯根据此分析得出关键的政策结论

Budget deficits

预算赤字

One, well known, is countering recession with budget deficits, which Keynes dealt with as `loan expenditure` - vulgarisation of Keynes lies in reducing his theories to support for budget deficits, not in the fact that he supported deficit spending. Keynes noted: `"loan expenditure" is a convenient expression for the net borrowing of public authorities on all accounts, whether on capital account or to meet a budgetary deficit. The one form of loan expenditure operates by increasing investment and the other by increasing the propensity to consume.` (Keynes, 1936, p. 128)

众所周知,预算赤字是伴随经济衰退而来,凯恩斯则将预算赤字称做"公债支出`",而"公债支出"这一通俗说法使得凯恩斯理论中支持预算赤字的力度有所减小,对于他所支持的赤字开支理论并没有影响。凯恩斯指出:"`公债支出`是一种惯用说法,表示政府当局一切帐目上的借款净额,不论借款是用于资本账目,还是用于弥补预算赤字。公债支出的一种形式是用于增加投资,另一种形式则是用于增加消费倾向。"(凯恩斯,1936年,《就业、利息和货币通论》,第 128页,中文第133页)

Therefore, in a famous passage: `If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines… and leave it to private enterprise… to dig the notes up again... with the help of repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater… It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.` (Keynes, 1936, p. 130)

因此,他指出:"如果财政部把用过的瓶子塞满钞票。而把塞满钞票的瓶子放在已开采过的矿井中,然后,用城市垃圾把矿井填平。并用听任私有企业根据自由放任的原则把钞票再挖出来。那么,失业问题便不会存在,而且受到由此而造成的反响的推动下,社会的实际收入和资本财富很可能要比现在多出很多。确实,建造房屋或类似的东西会是更加有意义的办法,但如果这样做会遇到政治和实际上的困难,那么,上面说的挖窟窿总比什么都不做要好。"(凯恩斯,1936年,《就业、利息和货币通论》,第 130页,中文第134页)

Such a view of deficit spending naturally did not mean Keynes was indifferent to what deficits should be spent on - today environmentally sustainable investment would be added to his existing list. He had scathing contempt for double standards regarding when deficits were justifiable: `Pyramid-building, earthquakes, even wars… may serve to increase wealth, if… our statesmen… stands in the way of anything better… common sense… has been apt to reach a preference for wholly "wasteful" forms of loan expenditure rather than for partly wasteful forms, which because they are not wholly wasteful, tend to be judged on strict "business" principles. For example, unemployment relief financed by loans is more readily accepted than the financing of improvements at a charge below the current rate of interest…wars have been the only form of large-scale loan expenditure which statesmen have thought justifiable.` (Keynes, 1936, p. 129)

当然,上述有关赤字支出的评论并不意味着凯恩斯对赤字使用的问题漠不关心--当前有关环境方面的可持性投资应参考他的理论。他对某些人就赤字辩护的双重标准表示严重不屑:"如果我们的政治家们由于受到古典经济学派经济学的影响太大,想不出更好的办法,那么建造金字塔、地震甚至战争都可以起着增加财富的作用。奇怪的是,流行的常识,为了摆脱古典学说所导致的荒谬结论,往往偏向于采用全部"浪费式的"举债支出的形式,而不是部分浪费式的形式,其原因在于:正是由于部分浪费式的形式并不是完全浪费的,所以,它的采用与否系按照严格的`企业经营`的原则加以判别。例如,用借款来筹措资金进行的失业救济要比用借款来筹措资金进行的效益小于现行利息率的设备改良来得容易为人们所接受,正如战争被政治家们认为是值得为之而进行大规模的举债支出的唯一形式一样。(凯恩斯,1936年,《就业、利息和货币通论》,第 129页,中文第133-134页)

Interest rates

利率

While Keynes supported deficit spending, the causes of recession lay in more fundamental factors affecting investment, which in turn were affected by interest rates: `the succession of boom and slump can be described and analysed in terms of the fluctuations of the marginal efficiency of capital relatively to the rate of interest.` (Keynes, 1936, p. 144) This was because marginal efficiency of capital was `equal to the rate of discount which would make the present value of the series of annuities given by returns expected from the capital-asset during its lift just equal to its supply price.` (Keynes, 1936, p. 135) Consequently, `inducement to invest depends partly on the investment-demand schedule and partly on the rate of interest.` (Keynes, 1936, p. 137)

与此同时,凯恩斯支持赤字支出,经济衰退是影响投资的最主要因素,这反过来会影响利率:"资本边际效率相对于利率的波动可以被用来解释和分析繁荣与萧条交替的行进。"(凯恩斯,1936年,《就业、利息和货币通论》,第 144页,中文第148页)。更确切地说,我把资本边际效率定义为一种贴现率,而根据这种贴现率,在资本资产的寿命期间所提供的预期收益的现在值能等于该资本资产的供给价格。(凯恩斯,1936年,《就业、利息和货币通论》,第 135页,中文第139页)因此:"投资动机部分取决于投资需求表,部分取决于利率。(凯恩斯,1936年,《就业、利息和货币通论》,第 137页,中文第141页)

As investment was affected by interest rates, therefore, a crucial issue to maintain investment at a sufficient level to sustain effective demand was a low interest rate. This problem, in turn, tended to become more acute because of the rising proportion of the economy devoted to investment: `Not only is the marginal propensity to consume weaker in a wealthy community, but owing to its accumulation of capital being already larger, the opportunities for further investment are less attractive unless the rate of interest falls at a sufficiently rapid rate; which brings us to the theory of the rate of interest and… reasons why it does not automatically fall to the appropriate levels.` (Keynes, 1936, p. 31)

因而为了维持有效需求,必须让投资保持在一个充足的水平。其中的关键问题是,要保持较低的利率水平。但这样又会因为投资占经济比重呈上升趋势而问题变得更加棘手:"在富裕的社会中,不仅边际消费倾向微弱,而且由于它的资本积累已经较多,除非利率以足够快的速度下降,进一步投资的机会就较难具有吸引力。这就使我们来研究利率理论并且考察为什么利率不能自动下降到应有水平的原因。"(凯恩斯,1936年,《就业、利息和货币通论》,第 31页,中文第36-37页)

The aim of low interest rates was to relaunch investment by ensuring that the return on investment was above the rate of interest plus whatever was the required premium to overcome liquidity preference. But, as Keynes openly acknowledged, such low term interest rates destroy the ability to live from income from interest - which is why, in his famous phrase, Keynes foresaw `euthanasia of the rentier.` (Keynes, 1936, p. 376) He concluded: `I see… the rentier aspect of capitalism as a transitional phase which will disappear.` (Keynes, 1936, p. 376)

低利率的目的是重新启动投资以确保投资收益高于利率和克服流动性偏好。但正如凯恩斯公开承认,这种短期利率不利于那些依靠利息收入生存的人们,也即是凯恩斯说出名言"食利者的安乐死"的原因。(凯恩斯,1936年,《就业、利息和货币通论》,第 376页,中文第393页)他得出结论:"我把资本主义体系中的食利者阶级看成一种过渡现象,它完成了其使命以后便消亡。"(凯恩斯,1936年,《就业、利息和货币通论》,第 376页,中文第393页)

`A somewhat comprehensive socialisation of investment`

某种程度的投资全面社会化

Nevertheless, despite support for low interest rates Keynes, did not judge these would be likely by themselves to overcome the effects of an investment decline. It would therefore be necessary for the state to play a greater role: `Only experience… can show how far management of the rate of interest is capable of continuously stimulating the appropriate volume of investment… I am now somewhat sceptical of the success of a merely monetary policy directed towards influencing the rate of interest… I expect to see the State… taking an ever greater responsibility for directly organising investment.` (Keynes, 1936, p. 164) Consequently Keynes believed that regulating the level of investment would have to be undertaken by the state and not by the private sector: `I conclude that the duty of ordering the current volume of investment cannot safely be left in private hands.` (Keynes, 1936, p. 320) It was necessary, therefore, to aim at `a socially controlled rate of investment.` (Keynes, 1936, p. 325)

然而,尽管凯恩斯支持低利率,但他并不认为低利率本身就会克服投资下降所带来的影响。因此,解决这一问题就需要政府发挥更大的作用:"然而,只有经验才能证明:在何种程度上,控制利息率能够持续地刺激投资,使它处于合适的水平。以我自己而论,我对仅仅用货币政策来控制利息率的成功程度,现在有些怀疑。我希望看到的是,处于能根据一般的社会效益来计算出长期资本边际效率的地位的国家机关承担起更大的责任来直接进行投资。"(凯恩斯,1936年,《就业、利息和货币通论》,第164页,中文第167页)。因此,凯恩斯认为,控制投资水平应由政府而不是私人部门承担:"我的结论是,我们不能把决定当前投资总量的职责放在私人手中。因此,有必要设法`由社会控制投资量`"。(凯恩斯,1936年,《就业、利息和货币通论》,

If, however, the state were to determine `the current volume of investment` then this led Keynes to the conclusion: `It seems unlikely that the influence of banking policy on the rate of interest will be sufficient by itself to determine an optimum rate of investment. I conceive, therefore, that a somewhat comprehensive socialisation of investment will prove the only means of securing an approximation to full employment.` (Keynes, 1936, p. 378)

不过,如果国家决定了"当前投资总量",那么凯恩斯会得到如下结论:"单靠银行政策对利息率的影响似乎并不足以决定一个适当的投资量。因此,我感觉到,某种程度的投资全面社会化,将证明是确保充分就业的唯一手段。"(凯恩斯,1936年,《就业、利息和货币通论》,第 378页,中文第394页)

Keynes noted that this `somewhat comprehensive socialisation of investment` did not mean the elimination of the private sector, but socialised investment operating together with a private sector: `This need not exclude all manner of compromises and devices by which public authority will co-operate with private initiative… the necessary measures of socialisation can be introduced gradually and without a break in the general traditions of society… apart from the necessity of central controls to bring about an adjustment between the propensity to consume and the inducement to invest there is no more need to socialise economic life than there was before…. The central controls necessary to ensure full employment will, of course, involve a large extension of the traditional functions of government.` (Keynes, 1936, p. 378)

凯恩斯指出,"某种程度的投资全面社会化"并不意味着消灭私营部门,而是和私营部门一起进行社会化投资操作:"这并不排斥一切形式的折衷方案,而通过这种方案,国家当局可以和私人的主动性结合起来。但除此以外,似乎很难证实囊括绝大部分社会经济生活的国家社会主义的必要性。此外,必要的社会化的步骤可以逐步采用,从而不会隔断社会的一般传统。由此可见,除了由中央控制的必要性来实现消费倾向和投资诱导之间的协调以外,我们没有比过去提出更多的理由使经济生活社会化。保证充分就业所需的中央控制当然会大幅扩大传统的政府职能。"(凯恩斯,1936年,《就业、利息和货币通论》,第 378页,中文第394-396页)

The conclusion

结论

It is now possible to clearly see the structure of Keynes`s argument. The rising proportion of the economy devoted to investment meant any downturn in the latter would have increasingly destabilising consequences. Budget deficits could deal with this to some degree, but as the key element was investment, which was determined by interaction between profits and interest rates, low interest rates was necessary. This would lead to the `euthanasia of the rentier`. However it was unlikely interest rates would be sufficient themselves and therefore the state would need to step in with `a somewhat comprehensive socialisation of investment` which would however work alongside a private sector.

读者朋友们现在应该可以清楚地了解凯恩斯理论框架。"投资占经济比重呈上升趋势"意味着前者的任何衰退会带来日益不稳定的后果。预算赤字在某种程度上可以应对这一问题,但因为关键因素是投资,而投资是由利润和利率之间的相互关系决定,因此低利率就很有必要。低利率会导致"食利者的安乐死"。然而,利率本身是不可能实现自动调节的,因此这就需要政府介入推动"某种程度的投资全面社会化",同时与私营部门一道协作。

Tracing this argument one has now arrived at a `Chinese` economic structure - although approaching it via a Keynesian and not a Marxist framework. `ZhuadaFangxiao`, grasping large state firms and releasing small ones to the non-state/private sector, coupled with abandonment of quantitative planning, means that China`s economy is not being regulated via administrative means but by general macro-economic control, including centrally of the level of investment - as Keynes advocated.

综上所述,相信读者朋友们现在已经对中国经济结构有所了解,虽然大家是通过凯恩斯经济学而非马克思主义框架角度了解的。"抓大放小"(保留大型国有企业为国有制,放活小型国有企业为非国有/私有制),加上放弃计划经济,意味着中国经济不再是计划经济管制模式,而是宏观调控模式,包括中央政府掌控投资水平--正如凯恩斯所主张的。

Implications

启示

What is the overall significance of this? Deng Xiaoping`s most famous economic statement is `cats theory` - `it doesn`t matter whether a cat is black or white provided it catches mice`. But `cats theory` can be applied to economics itself - it doesn`t matter whether something is described in Marxist or Western economic terms provided the same economic policies exist. `ZhuadaFangxiao` may be arrived at from either a Keynesian or a Marxist framework.

那么由此带来的总体意义是什么呢?邓小平最著名的经济表述是"猫论"--不管黑猫白猫,捉到老鼠就是好猫。但"猫论"也适用于经济学本身--不管马克思主义经济学还是西方经济学,只要能帮助人们解读经济政策,就是好的经济学理论。比如,"抓大放小"既可以从凯恩斯经济学角度来解读,也可以从马克思主义经济学来解读。

But while one may be indifferent to the colour of theoretical cats it is not possible to be indifferent as regards the policy measures to be taken - steps in budget deficits, interests rates, investment etc are material and precise. Here there is a radical difference in between the US and Europe on one side and China on the other.

人们可能对"猫论"颜色不感兴趣,但对政府当局所采取的预算赤字、利率和投资等经济政策不可能无动于衷,因为这些政策事关他们的切身利益。美国和欧洲在经济政策上的立场是相同的,中国的经济政策则与他们有着本质的区别。

In the US and Europe budget deficits have been utilised - although they are under increasing attack. Low central bank interest rates have been pursued and some forms of quantitative easing, driving down long term interest rates through central bank purchases of debt, have been used. But no serious programmes of state investment have been launched - let alone Keynes`s `somewhat comprehensive socialisation of investment`.

在美国和欧洲,预算赤字政策的运用由来已久,尽管这种政策受到的攻击不断。央行通过购买债券压低长期利率来实行低利率和某种形式的量化宽松政策。但严格意义上的国家投资计划从未实施,更不用说凯恩斯的"某种程度的投资全面社会化"。

In China, in contrast, relatively limited budget deficits have been combined with a state owned banking system (`euthanasia of the rentier`) and a huge state investment programme. While the West`s economic recovery programme has been timid, China has pursued full blooded policies of the type recognisable from Keynes General Theory as well as its own `socialism with Chinese characteristics.` Why this contrast and why has China`s stimulus package been so much more successful than the West`s?

相比之下,中国的国有银行体系让其拥有相对有限的预算赤字和庞大的国家投资计划。当西方谨小慎微地实施经济复苏计划时,中国则可以实行全面的经济复苏政策。中国执行经济政策时兼顾了凯恩斯《通论》中的部分主张和中国特色社会主义。为什么中国和西方的经济政策会有如此巨大的反差?为什么中国的一揽子经济刺激计划远比西方的经济政策成功得多?

Because in the US and Europe, of course, it is held that the colour of the cat matters very much. Only the private sector coloured cat is good, the state sector coloured cat is bad. Therefore even if the private sector cat is catching insufficient mice, that is the economy is in severe recession, the state sector cat must not be used to catch them. In China both cats have been let lose - and therefore far more mice are caught.

因为美国和欧洲认为猫的颜色很重要,只有私企颜色的猫才是好猫,国企颜色的猫则是坏猫。因此,即使私企颜色的猫抓不到足够多的老鼠,即经济陷入严重衰退,国企颜色的猫也不能抓鼠。中国则放手两种颜色的猫去抓鼠,因此中国能抓到更多的老鼠。

The recession in the Western economies, as foreseen by Keynes, is driven by decline in investment - in most countries decline in fixed investment accounted for two thirds to more than ninety per cent of the GDP fall at the peak of the Great Recession following the international financial crisis (Ross, Li, & Xu, 2010). Keynes`s calls for not only budget deficits and low interest rates but also for the state to set about `organising investment` are evidently required. But this is blocked because the state coloured cat is not allowed to catch mice.

正如凯因斯所预见的,西方经济体的衰退是由投资下降所导致的--继国际金融危机爆发以来,大多数国家的固定投资占GDP比重从大衰退前顶峰时的逾19%下降三分之二。(罗思义、李红柯和徐西池,2010年,《大衰退实质上是投资大崩溃》)。凯恩斯曾在《通论》中指出,解决这种问题不仅需要预算赤字和低利率,而且还需要国家制定投资规划。但这在西方行不通,因为国企颜色的猫不被允许抓鼠。

To put it another way, the US and Europe insist on participating in a race while hopping on only one leg - the private sector. China is using two legs, so little wonder it is running faster.

换句话说,美国和欧洲坚持仅用一条腿--私营企业参加比赛,中国则是用两条腿并行,所以中国跑得更快就不足为怪了。

To turn from metaphors to economic measures, a large scale state financed house building programme, or large scale expansion of transport, of the type China is followed as part of anti-crisis measures not only delivers goods that are valuable in themselves but boosts the economy through macro-economic effects in raising investment. But in the West such state investment is blocked as it creates competition for the private sector. As the top aim in the US and Europe is not to revive the economy, but to protect the private sector, therefore such large-scale investment must not be undertaken.

顺着上文的比喻,我们转向中国经济政策模式,即政府通过大规模资助住房建设和大规模发展交通运输系统作为部分反危机的措施。这些措施不仅能拉动商品本身价值,而且能通过宏观经济效应提高投资从而提振经济。但在西方,这样的政府投资会受到阻挠。因为政府投资会对私营企业造成竞争上的威胁。由于美国和欧洲推行经济举措的最高目标不是振兴经济,而是保护私营企业,如此大规模的投资计划是难以推出的。

It is an irony. Keynes explicitly put forward his theories to save capitalism. But the structure of the US and European economies has made it impossible to implement Keynes`s policies even when confronted with the most severe recession since the Great Depression. The anti-crisis measures of China`s `socialist market economy` are far closer to those Keynes foresaw that any capitalist economy. Whereas in the US, for example, fixed investment fell by over twenty five per cent during the financial crisis in China urban fixed investment rose by over thirty per cent. Consequently, there is no mystery why China`s economy grew by 80.1% between 2007 and 2014 compared to 8.1% in the US.Deng Xiaoping famously said his death was `going to meet Marx`. But Deng may also be having an intense talk with John Maynard Keynes. And Keynes would be interested to discuss with Deng`s two cats - who appear to have read the General Theory more closely and accurately than any administration in the West.

这是一种讽刺。凯恩斯的理论本是用来挽救资本主义的,但面临大萧条以来最严重的危机时,美国和欧洲国家的经济结构却使他们不可能推行凯恩斯的政策。相反,坚持社会主义市场经济体制的中国所采取的反危机举措较任何资本主义经济体更为接近凯恩斯的经济理论。例如,在金融危机期间,美国固定投资从25%以上滑落,中国城市固定投资则升至30%以上。因此,这是 2007 -2014 年期间,中国经济增长80.1%,而美国仅增长8.1%的原因。邓小平曾说过一句名言,称他死后要去见马克思。但邓小平也许还可以与约翰·梅纳德·凯恩斯来次深度对话,相信凯恩斯会对似乎比任何西方当政者更懂《通论》的邓小平感兴趣,并顺便与后者讨论猫论。

Put in more prosaic terms, China`s economic structure, because it allowed `a socially controlled rate of investment` and a `somewhat comprehensive socialisation of investment`, could utilise policy tools developed by Keynes but the US and European economies could not. Although Keynes explicitly wished to save capitalism it turned out that Western capitalism could not use his tools, but China`s `socialism with Chinese characteristics` could. Deng Xiaoping could not fit in the framework of Keynes, but Keynes could fit rather neatly within the framework of Deng Xiaoping.

简单说来,因为中国允许"社会控制投资量"和"某种程度的投资全面社会化"的经济结构,这使其可以采用凯恩斯提出的政策工具,但美国和欧洲国家却不能。虽然凯恩斯希望可以拯救资本主义,结果西方资本主义国家不能采用他的政策工具,反而是坚持中国特色社会主义制度的中国能。邓小平理论与凯恩斯理论框架并非一脉相承,但凯恩斯理论却契合邓小平理论框架。

As China`s economic policy and structure can be understood in either Keynesian or Marxist terms it is a more general issue which is to be preferred. `It doesn`t matter whether a cat is black or white provided it catches mice` might appear an appropriate response.

因为中国的经济政策和结构既可以从凯恩斯理论角度来解读,也可以从马克思主义角度来解读,所以大家可以根据自己的偏好任意选择其中一种理论。"不管白猫还是黑猫,逮到老鼠就是好猫"看起来是一个恰当的答复。

* * *

Notes and Bibliography

注释与参考文献

1. In the last twenty-five years China has lifted more than 620 million people out of absolute poverty. That is, according to the calculations of Professor Danny Quah of the London School of Economics, 100% of the reduction in the number of those living in absolute poverty in the world. (Quah, 2010) No other country remotely compares to China`s contribution to the reduction of world poverty - a fact placing legitimate, and illegitimate, criticism of China in an appropriate qualitative context.

过去二十五年,中国已带领6.2亿中国人摆脱绝对贫困,即根据伦敦经济学院柯成兴教授的计算结果,全球生活在绝对贫困线的人口数量减少了100%。(柯成兴,2010年)。没有任何其他国家能与中国对世界的减贫贡献相提并论--这一事实已经让那些对中国合理、亦或不合理的批评显得无足轻重。

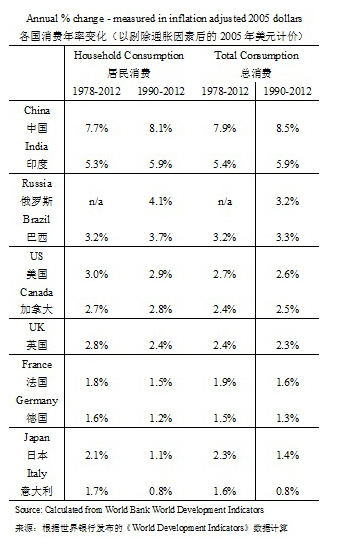

It is sometimes mistakenly argued that rapid economic growth in China has not aided consumption. This is an economic error - it confuses the percentage of consumption in GDP, which is low in China compared to other economies, with China`s rate of growth of consumption - which is the highest of any major country (see Table 1). The reason China has the fastest rate of growth of consumption in any major economy is because it has the fastest rate of GDP growth - in all economies the growth rate of GDP is highly correlated with the growth rate of consumption.

人们有时会错误地认为,中国经济快速增长并不是借助消费。这是一个错误的经济解读--它混淆了消费占GDP比重和消费增长率。与其他经济体相比,中国的消费占GDP比重较低,虽然中国消费增长率高于任何主要经济体(见表1)。中国消费增速在所有主要经济体中最高的原因是其拥有最高的GDP增速--所有经济体的GDP增长率与消费增长率高度相关。

Table 1

表1

Bibliography

参考文献

Deng, X. (2 June 1978). `Speech at the all-army conference on political work`.In X. Deng, Selected Works of Deng Xiaoping 1975-1982 (2001 ed., pp. 127-140). Honolulu: University Press of the Pacific.

见邓小平1978年6月2日讲话《在全军政治工作会议上的讲话》,摘自《邓小平文选》第2卷(1975-1982 )第127-140页(2001年版),由太平洋大学出版社出版。

Friedman, M. (1957). A Theory of the Consumption Function. Princeton: Princeton University Press.

见弗里德曼(M. Friedman)1957年所著的《消费职能理论》(A Theory of the Consumption Function),由普林斯顿大学出版社出版。

Hsu, R. C. (1991). Economic Theories in China 1979-1988. Cambridge and New York: Cambridge University Press.

见罗伯特.徐(R. C. Hsu) 1991年所著的《对1979-1988年中国经济理论的分析》(Economic Theories in China 1979-1988),由剑桥大学出版社出版。

Keynes, J. M. (1936). The General Theory of Employment, Interest and Money(Macmillan 1983 ed.). London: Macmillan.

见凯恩斯1936年所著的《就业、利息和货币通论》(The General Theory of Employment, Interest and Money)1983年版,由Macmillan出版。

Maddison, A. (1992). `A Long Run Perspective on Saving`. Scandanavian Journal of Economics, 94(2), 181-196.

见麦迪森(A. Maddison)1992年所著的《从长期视角看储蓄》(A Long Run Perspective on Saving),载于《斯堪的纳维亚经济学杂志》第94卷第2章第181-196页。

Marx, K. (1867). Capital Vol.1 (1988 ed.). (B. Fowkdes, Trans.) Harmondsworth: Penguin.

见马克思1867年所著的《资本论》第1卷(1988年版,由福克斯翻译),由Penguin出版。

Quah, D. (2010, May). `The Shifting Distribution of Global Economic Activity`.Retrieved January 2, 2012, from London School of Economics: econ.lse.ac.uk/~dquah/p/2010.05-Shifting_Distribution_GEA-DQ.pdf

见柯成兴(D. Quah)2010年5月所著的《全球经济活动的转移分布》,2012年1月2日检索自伦敦经济学院网站:econ.lse.ac.uk/~dquah/p/2010.05-Shifting_Distribution_GEA-DQ.pdf

Ross, J. (2011, June 22). `Why Adam Smith`s `classical theory` correctly explained Asia`s growth - and how this clarifies why Paul Krugman`s critique of Asian growth failed to predict events`. Retrieved June 22, 2011, from Key Trends in Globalisation: http://ablog.typepad.com/keytrendsinglobalisation/2011/06/adam_smith.html

见罗思义(John Ross)2011年6月22日所著的《为什么亚当·斯密的"古典经济理论"可很好地诠释亚洲增长模式以及保罗·克鲁格曼批判亚洲增长模式的预测会失败?》,2011年6月22日检索自《全球化的主要趋势》:http://ablog.typepad.com/keytrendsinglobalisation/2011/06/adam_smith.html

Ross, J., Li, H., & Xu, X. C. (2010, June 29). `The Great Recession` is actually `The Great Investment Collapse` . Retrieved July 30, 2010, from Key Trends in Globalisation: http://ablog.typepad.com/keytrendsinglobalisation/2010/06/the-great-recession-is-actually-the-great-investment-collapse-by-john-ross-li-hongke-and-xu-xi-chi.html

见罗思义、李红柯和徐西池2010年6月29日所著的《大衰退实质上是投资大崩溃》(The Great Recession` is actually `The Great Investment Collapse`),2010年7月30日检索自《全球化的主要趋势》:http://ablog.typepad.com/keytrendsinglobalisation/2010/06/the-great-recession-is-actually-the-great-investment-collapse-by-john-ross-li-hongke-and-xu-xi-chi.html

Smith, A. (1776). An Inquiry into the Nature and Causes of the Wealth of Nations(1981 ed.). Liberty Edition Volume 1.

见亚当·斯密1776年所著的《国富论》第1卷,(1981年馆藏版本)。