发布时间:2016-03-09 作者: 罗思义

中国的增长成就是世界最大的经济发展成就,不仅影响了世界GDP,而且改善了人类福祉。结合中国与亚洲的发展成就来看更具普遍意义,因此同样能批判性检验经济理论。任何有效的经济发展理论必须能准确预测亚洲和中国的经济增长成就,任何未能预测中国经济发展成就的经济增长理论都是有问题的

Online Appendix 1 - Adam Smith’s Theory of Economic Growth

在线技术附录1:亚当·斯密的经济增长理论

The growth of China is the world’s biggest economic development not only in terms of its effects on world GDP but in its improvement in human welfare. It is, together with Asia’s development more generally, therefore an equally critical test of economy theory. Any valid theory of economic development must accurately predict Asia and China’s economic growth. Any theory of economic growth which failed to predict China’s economic development is wrong.

中国的增长成就是世界最大的经济发展成就,不仅影响了世界GDP,而且改善了人类福祉。结合中国与亚洲的发展成就来看更具普遍意义,因此同样能批判性检验经济理论。任何有效的经济发展理论必须能准确预测亚洲和中国的经济增长成就,任何未能预测中国经济发展成就的经济增长理论都是有问题的。

China’s own theory of its economic growth, which guided its developmentclearly passes that test. It is analysed in Online Appendix 2. That theory is, however, constructed in Marxist terms with which most Western readers will either be unfamiliar. Another theory which may be used to analyse China’s economic development is Adam Smith’s – as has been shown in this book. As stated, however, a proviso is that this must be what Adam Smith actually wrote and not what some people imagine he wrote. In order to avoid a long textual exegesis, which is primarily of interest to specialists, the references to Adam Smith’s theory of economic development were only summarised in the chapters of this book. This online appendix, therefore, gives a fuller account of the internal logic of Smith’s analysis, for economic specialists,.

中国自己的引导其发展的经济增长理论显然已通过了检验,相关分析参见在线技术附录2——《用马克思主义分析中国经济改革》。不过,中国的经济增长理论与大多数西方读者不了解的马克思主义一脉相承。因此,本书前文所提到的另一种理论——亚当.斯密的经济增长理论可用来分析中国经济发展成就。然而,如上所述,前提条件是这必须的确是亚当.斯密亲作,而非有些人臆想中的他写的作品。为避免主要对此内容感兴趣的业内专业人士嫌全书正文过于冗长,本书仅在部分章节引用了亚当.斯密经济发展理论的概述。因此,本在线附录在文末所附的文章为业内专业人士提供了一个全面了解斯密内在逻辑分析的机会。

It is also clear that a number of Western theories of economic growth do not survive the test of China’s and Asia’s economic development. The most representative of these, as the most famous, may be taken to be Paul Krugman’s wellknown article ‘The Myth of Asia`s Miracle’. This predicted that Asia’s economic growth would fail. Krugman particularly singled out for criticism Singapore. Actual economic development, however, has over a prolonged period failed to correspond to Krugman’scritiques. Not only has the growth of the East Asian ‘emerging’ economies continued, but the most developed, Singapore, achieved a higher per capita GDP than the US.

很显然,一些西方增长理论无法通过中国与亚洲经济发展成就的检验,其中最具代表性且最有名的例子当属保罗·克鲁格曼(Paul R. Krugman)的著名文章《亚洲奇迹之谜》(The Myth of Asia`s Miracle)。克鲁格曼在此书中预测亚洲经济增长模式将以失败告终,他还特别点名批评了新加坡。但是,在很长一段时间内,亚洲实际经济发展并未如克鲁格曼所批判的那样以失败告终,不仅东亚新兴经济体继续保持高增长率,而且最发达的新加坡的人均GDP也超过了美国。

This online appendix therefore gives both a detailed outline of Adam Smith’s theory and the errors of Krugman. It was published as “Why Adam Smith’s ‘classical theory’ correctly explained Asia’s growth - and how this clarifies why Paul Krugman’s critique of Asian growth failed to predict events.”

拙著《为什么亚当·斯密的“古典经济理论”可很好地诠释亚洲增长模式以及保罗·克鲁格曼批判亚洲增长模式的预测会失败》详细概述了斯密的理论和克鲁格曼的错误,如果大家对此感兴趣,请在线查阅:http://ablog.typepad.com/keytrendsinglobalisation/2011/06/adam_smith.html

* * *

The growth of Asia’s rapidly developing economies is a vital practical issue for the living standards of billions of people and a decisive test of economic theory. This group of economies are the world’s most rapidly growing. They include the only major economies that have made the entire transition from ’low income developing’ to ‘developed‘ status. Those economies in the group which have already achieved developed status continue to grow more rapidly than their equivalents in North America, Japan and Europe. The largest economy in the group, China, has undergone the most rapid growth of any major country for more than thirty years.

亚洲快速发展经济体的增长不仅是关乎数十亿人民生活水平的重要实践问题,也是关乎检验经济理论对错的关键所在。这个经济体是世界上发展速度最快的,它涵盖了唯一完成了从“低收入发展”到“发达水平”过渡的主要国家。而这些已经达到发达水平的经济体仍以超过来自北美、日本和欧洲的其他发达经济体的速度向前发展。其中最大的经济体是中国,在过去三十多年间,它实现了比任何国家都快的经济发展。

It would therefore at first sight appear evident that the rest of the world would wish to understand the reasons for this success and emulate it. Indeed it would appear extremely important to do so – if the rest of the world could enjoy the same economic development as East Asia then international problems of underdevelopment and poverty would be overcome within little more than a generation.

首先看来,世界各地显然希望了解这种成功并试图效仿。事实上这样做也非常重要。因为如果世界其他地方也可以享有东亚经济的成功发展,那么欠发达和贫穷等世界问题就有可能在不到一代人的时期内得以解决。

However, a significant number of authors have adopted an opposite course. The success of Asia’s economies is considered sufficiently contradictory to certain economic theories that the facts of its success have to be denied or treated as temporary or limited. As it is difficult to neglect economic development that has already occurred, this approach has taken the form of attempts to demonstrate that Asia’s growth must come to an end ‘soon’, or at least at levels of income per head which are below those of the US and Europe. The most famous of such critiques probably remains Paul Krugman’s ‘The Myth of Asia`s Miracle’ (Krugman, 1994)

然而,相当一部分经济学者却采用相反的态度来看待这一问题。他们认为,亚洲经济体的成功与特定的经济理论明显相悖,因此所谓的亚洲成功模式不成立,或者短暂而又有局限性。由于经济发展事实不容忽视,这部分学者就转向试图证明亚洲的发展很快就会终止,至少其远低于欧美的人均收入水平的增长是难以为继的。持此批评论断最有名的可能仍然是保罗·克鲁格曼的《亚洲奇迹的神话》。(克鲁格曼,1994年)

Actual economic development, however, has over a prolonged period failed to correspond to such critiques. Not only has the growth of the East Asian ‘emerging’ economies continued, but the most developed, Singapore, has achieved a GDP per capita higher, in parity purchasing powers (PPPs), than the US. This latter fact might, indeed, be considered ‘revenge of reality over (erroneous) theory’ as Paul Krugman singled out Singapore for perhaps the most comprehensive criticism for relying on an ‘extensive’ pattern of economic growth, dependent on accumulation of factor inputs of capital and labour, rather than on increases in total factor productivity (TFP).

在很长一段时间内,实际的经济发展都与该论断不符:东亚“新兴”经济体的发展仍在继续,而且发展程度最好国家(新加坡)的人均国内生产总值(以购买力平价来计算)已经超过了美国。后者的确可看作是“现实对(错误)理论的有力回击”,而克鲁格曼也单独将新加坡加以批评,正如它被广泛批评的那样,新加坡是粗放的经济增长模式,经济发展依赖于资本和劳动力生产要素的持续积累,而不是全要素生产率的提高。

Such critical assessments of the East Asian economies are logically linked to theories of growth of the developed economies. The East Asian economies share with the developed countries, during the post-war period, a rejection of ‘import substitution’ strategies – both groups pursued ‘open’ economic policies with a high and rising percentage of foreign trade in GDP. However, the rapidly growing East Asian countries strongly differed from the developed ones in having a far higher percentage of fixed investment in GDP. Indeed, East Asian economies typically pursued policies which favoured, or consciously aimed at, such high investment levels.

以上对东亚经济的批判是与发达国家经济增长理论相关联的。战后一段时期内,东亚经济体与发达国家一样,抛弃了“进口替代”战略,并推行“开放式”经济发展模式,即维持并增长外贸占国内生产总值的比率。然而,快速增长的东亚国家在固定投资占国内生产总值的比率上明显高于发达国家。实际上,东亚经济体通常采取高投资水平的经济政策,或者这也有意为之。

According to various critiques of the ‘Asian growth model’ it was precisely this high level of mobilisation of capital that represented an ‘extensive’ path of development which would allegedly inevitably come up against its own limits and produce inability of East Asian economies to achieve the levels of GDP per capita of developed economies. The expansion of the developed economies, in contrast, was claimed to be based on TFP growth – a model originally associated with Solow and endorsed explicitly by Krugman.

根据“亚洲增长模式”的各种批判,代表“粗放式”发展路径的高资本流动率被认为不可避免地会限制其自身发展,进而使东亚国家的人均国内生产总值无法达到发达国家的水平。相比之下,发达经济体的发展是基于全要素生产率的提高——这种模型原创于索洛,由克鲁格曼得以继承和发展。

In reality, as facts demonstrated, the East Asian growth model - as confirmed in the most economically developed version by Singapore, Hong Kong, Taiwan and South Korea - has shown itself not only able to achieve extremely rapid rates of growth over prolonged periods but fully able to achieve the level of GDP per capita of developed economies. Furthermore, East Asian economies which have achieved the levels of GDP per capita of developed economies have continued to grow more rapidly than their US, Japanese and European counterparts. Therefore, whether considered from the point of view of growth from developing to developed economy status, or from the point of view of performance after achieving developed economy status, it is the Asian economies which are outperforming Europe and North America, not vice versa.

事实表明,东亚增长模式,尤其是像新加坡、香港、台湾以及韩国这些经济较发达地区所证实的那样,不仅可以在较长时期内保持较快增长率,而且完全有能力实现发达国家人均国内生产总值。更进一步说,这些已经达到发达国家人均国内生产总值的东亚经济体仍将以超过美国、日本和欧洲国家的发展速度继续向前发展。因而,不论是从发展中水平实现发达水平的转变,还是在实现发达水平后的表现,东亚经济体的经济发展都超越了欧美,而不是相反。

If there exists a contradiction between reality and a theory, a scientific approach demands that it is the theory that is changed or abandoned, not that the facts should be disregarded. Furthermore, as will be seen, there is an economic theory which coherently explains the facts both of Asian economic development and that of the developed economies. This may be termed the ‘classical’ theory of economic growth – classical in the strict sense that its formulation was by Adam Smith.

当现实与理论出现矛盾时,科学的要求是改变或放弃理论,而不是把事实置之不理。换句话说,如下所述,目前存在一种经济理论,它既可以解释亚洲的经济发展,也可以分析发达经济体的经济发展。这就是“古典”经济学,即严格意义上亚当·斯密的经济理论。

The aim of this article, therefore, is to set out the features of this ‘classical’ theory of economic growth, as formulated by Smith himself, and to show its vindication by modern econometrics. The character of this classical theory will be cast in sharper relief by contrasting its key points to alternative theories which have failed to explain the combined phenomena of the growth of the Asian and developed economies.

因而这篇文章旨在解析亚当·斯密的“古典”经济增长理论,并用现代计量经济学为其平反。该理论的主要特征在与其他经济理论的针锋相对中凸显出来,而后者是无法同时解释亚洲和发达国家的发展状况的。

Distinguishing features of the classical theory of growth

“古典”经济增长理论的特点

Adam Smith established four fundamental, interrelated, propositions which may be taken to characterise his ‘classical’ theory of economic growth. These are:

亚当·斯密建立的四个基本并相关的假设塑造了“古典”经济增长理论的基本特征。这些假设包括:

1. The most fundamental force of productivity growth is increasing division of labour.

生产率增长的最根本推动力是分工水平的提高。

2. Increasing division of labour requires increasing scale of production and an increasing scale of market.

劳动分工的增加要求更大规模的生产和更大范围的市场。

3. Increasing division of labour and scale of production leads historically to an increasing percentage of investment in the economy.

从历史角度来看,劳动分工的增加以及生产规模的扩大会导致经济中投资比例的提高。

4. Technological progress is a product of this increasing division of labour – i.e. it is endogenously and not exogenously determined.

技术进步是劳动分工提高的必然结果,即技术进步是内生而非外生变量。

The specificity of this classical theory becomes clearer if contrasted to the alternative views to which it is counterposed.

如果我们将古典经济学理论与其他观点完全相反的经济理论进行比对,我们会更清晰的看到古典经济学理论的特色所在。

• In the classical theory, economic growth is driven by division of labour, not by ‘entrepreneurship’, as in Schumpeter’s growth theory for example.

• 在古典经济理论中,是劳动分工推动了经济的发展,而不是熊彼特理论中的“创新”推动着经济发展。

• Smith’s view that the percentage of the economy devoted to investment rises historically was followed by others, including Keynes, but such a conclusion was challenged by Friedman and still does not play a central role in many growth theories – indeed, as noted, an extremely high investment level is seen as a policy error in the development of the East Asian economies.

• 斯密认为经济发展中的投资比例会历史性的增加,凯恩斯等其他人延续了这一观点,但受到弗里德曼的质疑,至今在增长理论中没有起到重要作用。事实上,正如之前所提到的,不少经济学家认为,东亚经济体的发展模式,即经济中高比例的投资是错误的政策。

• In Smith’s analysis technological process is driven by the consequences of division of labour, rather than technology being an external driving force of productivity - as for example in the analysis of views typically deriving from Solow.

• 在斯密的分析框架中,技术进步是由劳动分工结果引起的,而非推动生产力的外生变量—在索洛理论中就是如此。

Because of the importance of these issues, Smith’s ‘classical’ analysis will therefore be set out in more detail before showing its vindication in the light of modern econometric evidence.

由于这些问题的重要性,在用现代计量经济学为斯密的古典经济理论正名之前,本文将首先详细阐释斯密的“古典”经济理论分析。

Division of labour

劳动分工

Adam Smith unequivocally establishes division of labour as the fundamental lynch pin of productivity growth by stating it as the first sentence of the first chapter of The Wealth of Nations. This asserts simply:

斯密毫不含糊地把劳动分工作为生产力增长的根本前提,并将这句话放在《国富论》第一章的第一句。这句话简述如下:

‘The greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgement with which it is directed, or applied, seem to have been the effect of the division of labour.’ (Smith, 1776, p. 13)

“社会生产力、人类劳动技能以及思维判断力的大幅提高都是劳动分工的结果。”(斯密,1776年,13页)

The whole first three chapters of The Wealth of Nations are devoted to the division of labour. Later, reprising his views after elaboration of further developments, Smith choses to remind his readers ‘perfection of manufacturing industry, it must be remembered, depends altogether upon the division of labour.’ (Smith, 1776, p. 680)

《国富论》前三章都是阐释劳动分工的。接着,斯密在详细阐述有关劳动分工深远发展的观点之后,他又着重强调道,“我们必须记得,制造业的更好发展依赖于劳动分工”(斯密,1776年,680页)

Indeed, Smith formulated his view of division of labour as the driving force of productivity development and economic growth well before writing The Wealth of Nations. In his Lectures on Jurisprudence of the 1760s he noted, in a comparison incorporated wholesale into his magnum opus1:

实际上,在写《国富论》之前,斯密就认为劳动分工是推动生产力发展和经济增长的动力了。他在17世纪60年代的有关法理的演讲中曾经提到这一观点,并在其巨著《国富论》中进行了全面的阐释和比对1:

‘In yesterday’s lecture I endeavoured to explain the causes which prompt man to industry and are peculiar to him of all the animals… These wants a solitary savage can supply in some manner, but not in that which is reckoned absolutely necessary in every country where government has been some time established…

“在昨天的演讲中,我解释了推动人类迈向工业化以及人类与动物不同的原因所在……。这些原因所需要的是一个可以用某种方式来提供供给的鼓励未开化的人,而不是在每个国家中被认为是理所当然的方式,比如在某一时刻政府已经实现了供给……。

‘The unassisted industry of a savage cannot any way procure him those things which are now become necessary to the meanest artist. We may see this… in comparing the way of life of an ordinary day-labourer in England or Holland to that of a savage prince, who has the lives and liberties of a thousand or 10,000 naked savages at his disposal. It appears evident that this man, whom we falsely account to live in a simple and plain manner, is far better supplied than the monarch himself. Every part of his clothing, utensils, and food has been produced by the joint labour of an infinite number of hands, and these again required a vast number to provide them in tools for their respective employments. So that this labourer could not be provided in this simple manner (as we call it) without the concurrence of some 1,000 hands.

“未开化人们独立的产业是无法通过任何方式使他们拥有那些现在看来变成最吝啬的工艺家所必须的东西。我们可以用这种方式来看……通过对比英国或者荷兰的普通工人与一个未开化国家王子的生活方式就可以知道。王子一般拥有支配1,000或者10,000奴隶生活和自由的权利。这类普通工人,我们会错误的认为他过着简单而平凡的生活,其实他们与君主相比,普通人反而可以提供更多的供给。普通工人衣服、平日用具以及食物来自于无数人的合作分工,而且这些人再次又会需要更多的工具来完成他们自身的工作。因而没有大约1000双手的合作,即便按照简单方式也无法取得他生活所需的日用品的供给。(这正是我们称之为的所谓的“简单方式”)

‘His life indeed is simple when compared to the luxury and profusion of an European grandee. But perhaps the affluence and luxury of the richest does not so far exceed the plenty and abundance of an industrious farmer as this latter does the unprovided… manner of life of the most respected savage.... In what manner then shall we account for the great share he and the lowest of the people have of the conveniences of life. The division of labour amongst different hands can alone account for this.’ (Smith, Lectures on Jurisprudence, p. 341 – English spelling modernised)

“实际上,当我们将普通工人的生活与一个欧洲贵族丰富且奢华的生活对比的话,普通工人的生活显然是简单的。但是至今为止,这种富人般的丰富而奢华的生活或许至今未能与一个勤劳的农民所拥有的生活相媲美,因为后者的生活方式是最普遍的野蛮人的生活方式……用哪种方式我们可以解释农民和最底层人民所享有的生活是便利的。只有众多双手共同实现的劳动分工可以解释。”(斯密,有关法律的演讲,341页—英文现代化拼写版本)

Smith was naturally not the first economist to note division of labour.2 However, he was the first to unequivocally identify it as the most fundamental force of economic development and draw out the conclusions which followed from this.3 Smith therefore noted as a necessary consequence that the more developed, i.e. the more productive, an economy was the more developed division of labour would have to be:

但斯密是第一个明确认为劳动分工是经济发展基本动力的经济学家2,并基于此给出了如下结论,即一个经济体发展的越好,生产力越发达,其分工则会更加的精细3。

‘The division of labour, however, so far as it can be introduced occasions, in every art, a proportionable increase of the productive powers of labour. The separation of different trades and employments from one another seems to take place in consequence of this advantage. This separation, too, is generally carried furthest in those countries which enjoy the highest degree of industry and improvement.’ (Smith, 1776, p. 15)

“然而,至今为止在每一个工艺领域,由于分工可以适应不同的场合,劳动力效率会提高一定的比例。人与人之间的分工合作在不同贸易和雇佣劳动中得以体现,这是劳动分工优势的结果。而且这一劳动分工一般可以给那些产业和经济发展最发达的国家带来最深刻的影响,”(斯密,1776年,15页)

Smith drew the consequent conclusion that economic areas, whether sectors or countries, where division of labour could not be or was not pursued would be less productive.4

从中斯密得到如下结论,不管是行业还是国家层面的经济领域,没能实现劳动分工或者不追求劳动分工的,其生产力程度必然会低4。

Scale of production/market

生产/市场规模

Given that division of labour is the most fundamental and underlying driving force raising productivity, Smith drew the immediate conclusion that the possibilities of division of labour depend on the scale of the market and scale of production. Chapter 3 of The Wealth of Nations is straightforwardly titled ‘That the division of labour is limited by the extent of the market’. In its first paragraph Smith notes:

既然劳动分工是提高生产力基本且隐含的驱动力,那么斯密便会迅速得到如下结论,即劳动分工取决于市场和生产的规模。《国富论》中,第三章题目就是“论劳动分工受市场规模的限制”。斯密在第一段中提到:

‘the extent of this division must always be limited by... the extent of the market. When the market is very small, no person can have any encouragement to dedicate himself entirely to one employment, for want of the power to exchange all that surplus part of the produce of his own labour.’ (Smith, 1776, p. 31)

“分工的程度要受……市场大小的限制。市场要是过小,就无法鼓励人们始终专于一业,因为在这种状态下,他们不能用自己劳动生产物的剩余物随意交换自己所需”。(斯密,1776年,31页)

Scale of market is linked to scale of production at numerous levels:

在不同经济发展水平下,市场范围和生产范围也是相关联的:

‘There are some sorts of industry, even of the lowest kind, which can be carried on nowhere but in a great town. A porter, for example, can find employment and subsistence in no other place... It is impossible that there should be such a trade as even that of a nailer in the remote and inland parts of the Highlands of Scotland. Such a workman at the rate of a thousand nails a day, and three hundred working days in the year, will make three hundred thousand nails in the year. But in such a situation it would be impossible to dispose of one thousand, that is, of one day`s work in the year. (Smith, 1776, p. 31)

“有些职业,即便是普通的职业只能在大城镇存在。如搬运工,无法在除了大城镇之外的地方找到工作并得以生存。在荒凉的苏格兰高地,那些人迹稀少的小乡村,甚至不可能会有制钉这一行业。如果制钉工人每天能生产1000枚铁钉,他们每年能生产出30万枚铁钉。但在苏格兰的穷乡僻壤间,即便像制钉这样的行业不可能存在,因为一年不可能售出1000枚铁钉。”(斯密,1776年,31页)

It may be noted from this that Smith has a much wider concept of the advantages of large scale production than the more limited sense in which most frequently the term ‘economies of scale’ is used. The concept ‘economy of scale’ is typically used as relating to a single productive unit, and the cost reductions that may be achieved by large as opposed to small scale production in it. Smith utilises a much wider sense that a large market, and therefore large scale production, makes possible division of labour - which is itself the most powerful force for raising productivity. Therefore, scale of market raises productivity in the entire economy, and not only in a single productive unit. Thus, completing a passage already cited, he notes:

从中我们可以看到,斯密对大规模生产的优势理解是广义的,而不仅仅局限于常常提到的“规模经济”。“规模经济”通常是指对于同一产品生产,其大规模生产的成本要低于小规模生产。斯密的理论是广泛意义上的规模经济,即大市场下的大规模生产,使得劳动分工成为可能—而劳动分工是促进生产力发展的最有力因素。因而,市场规模提高了整个经济的生产力发展水平,而不是对某一特定产品生产而言的。从而斯密用一整段话来阐释这一观点:

‘The perfection of manufacturing industry, it must be remembered, depends altogether upon the division of labour; and the degree to which the division of labour can be introduced into any manufacture, is necessarily regulated, it has already been shown, by the extent of the market.’ (Smith, 1776, p. 680)

“我们应该铭记,制造业的完美发展得益于劳动分工;而劳动分工的程度可以应用在各个制造业领域,但我们很有必要控制这个分工程度。市场的范围决定了劳动分工的程度。”(斯密,1776年,680页)

It may immediately be seen from this that the advantages of foreign trade flow from increased possibility of the division of labour, and not some specific virtue of crossing international borders. While The Wealth of Nations is most famous for its advocacy of free trade between countries, this is a by-product of the fact that the fundamental driving force of economic and productivity growth is division of labour - the significance of international trade is that it makes possible a larger development of the market, not that it crosses national boundaries.5 To illustrate this Adam Smith, for example, in discussing the advantages of reduction in transport costs via water travel, a crucial factor in his day, does not distinguish national and international transport – no distinction is drawn in principle between the trade between London and Newcastle and London and Calcutta:

我们可以快速得出结论:对外贸易的优势来自劳动分工可能性的增加,而不是来自跨越国界的特定好处。虽然《国富论》以提倡自由贸易而著称,但它却是劳动分工推动经济和生产率增长的副产品—国际贸易的意义在于使市场有更大发展,而不是跨越国界本身5。为了阐明这点,亚当·斯密举例水运,这是他那个时代最为重要的生产要素,在降低运输成本方面,是不分国内还是跨国运输的—伦敦和纽卡斯尔间的贸易与伦敦和加尔各答间的贸易没有根本区别。

‘As by means of water-carriage a more extensive market is opened to every sort of industry than what land-carriage alone can afford it, so it is upon the sea-coast, and along the banks of navigable rivers, that industry of every kind naturally begins to subdivide and improve itself, and it is frequently not till a long time after that those improvements extend themselves to the inland parts of the country.... A broad-wheeled wagon, attended by two men, and drawn by eight horses, in about six weeks time carries and brings back between London and Edinburgh near four ton weight of goods. In about the same time a ship navigated by six or eight men, and sailing between the ports of London and Leith, frequently carries and brings back two hundred ton weight of goods ... What goods could bear the expense of land-carriage between London and Calcutta? Or if there were any so precious as to be able to support this expense, with what safety could they be transported through the territories of so many barbarous nations? Those two cities, however, at present carry on a very considerable commerce with each other, and by mutually affording a market, give a good deal of encouragement to each other`s industry. (Smith, 1776, p. 32)

“在货物的运输方面,水路比陆路运输开拓了更宽广的市场,因而各种产业的分工变革都始于水运便利之处。由于水运好处巨大,工艺和产业的最初改进自然开始于此,而这种改进推广到内陆地区则会经历漫长的时间……现在,以御者二人马八匹,驾四轮运货车一辆,载重约四吨货物,往返伦敦和爱丁堡之间,日程大约为六个星期。然而由六人或八人驾驶船一艘,载重二百吨货物,往返伦敦和利斯之间,日程同上……有什么货物可以负担的起伦敦和加尔各答的陆路运费呢或者即便存在这种货物,又有什么运输方法能使货物安然通过介于两地之间的众多野蛮民族的领土呢?然而,现如今这两个都市,相互间进行大规模的贸易,相互间提供市场,并对彼此的产业发展,相互给予很大的鼓励。”

Similarly, discussing China Smith notes the advantage of its very large internal market, and explains the advantages of foreign trade precisely in terms of the expansion of this market still further:

同样地,至于中国,斯密注意到其庞大国内市场带来的优势,并解释到对外贸易的好处恰恰在于它进一步扩大了国内市场。

‘the great extent of... China, the vast multitude of its inhabitants, the variety of climate, and consequently of productions in its different provinces... render the home market of that country of so great extent as to be alone sufficient to support very great manufactures. The home market of China is, perhaps, in extent not much inferior to the market of all the different countries of Europe put together. A more extensive foreign trade, however, which to this great home market added the foreign market of all the rest of the world… could scarcely fail to increase very much the manufactures of China, and to improve very much the productive powers of its manufacturing industry.’ (Smith, 1776, p. 681)

“中国幅员辽阔,国土面积那么大,居民众多,各种各样的气候,因此各省都有自身具有特色的产物……所以单单这个广大的国内市场就足以支持很大的制造业中国的国内市场或许并不比所有的欧洲不同国家加总起来的市场差。然而,如果能在国内市场之外,再加上世界其余各地的市场,那么更广大的国际贸易,必定可以大大促进中国制造业的发展,大大改进其制造业的生产力。”(斯密,1776年,681页)

Smith also saw the consequences of what, in modern terminology, would be termed effective demand on productivity as operating through increasing the scale of the market and thereby division of labour:

斯密同样也看到了,有效需求(用现代术语来说)通过市场规模和劳动分工的增长而对生产力产生了影响。

‘The increase of demand, besides, though in the beginning it may sometimes raise the price of goods, never fails to lower it in the long-run. It encourages production, and thereby increases the competition of the producers, who, in order to undersell one another, have recourse to new divisions of labour and new improvements of art which might never otherwise have been thought of.’ (Smith, 1776, p. 748)

“而且,虽然在初始阶段需求的增加可能会使货物的价格上涨,但是长期来看,需求的增加将会使物价下跌。需求的增加有助于生产力的提高,进而有利于生产者竞争力的增加。为了可以有序地抛售产品,生产者必须拥有劳动分工以及生产技术的新提高这些资源来做保证,而这些是之前的生产者不曾想过的。”(斯密,1776年,748页)

Level of investment

投资水平

If division of labour was the most fundamental force in raising productivity, Smith noted that increasing division of labour required more capital. Where division of labour did not occur significant investment, referred to by Smith as ‘stock’, was not required:

如果劳动分工是提高生产力的根本动力,那么斯密认为劳动分工的增加则需要更多资本的投入。没有劳动分工,重大投资(斯密称之为“存货”)就没有必要。

‘In that rude state of society in which there is no division of labour, in which exchanges are seldom made, and in which every man provides everything for himself, it is not necessary that any stock should be accumulated or stored up beforehand in order to carry on the business of society.’ (Smith, 1776, p. 276)

“在一个没有分工的未开化状态下的社会中,很少会有交换产生,每个人力图依靠自己的劳动满足自己的需要,那么任何为了经营社会事业而增加或者积累存货是没有必要的。”(斯密,1776年,276页)

In contrast division of labour required investment:

恰恰相反,劳动分工需要投资:

‘When the work to be done consists of a number of parts, to keep every man constantly employed in some way, requires a much greater capital than where every man is occasionally employed in very different parts of the work.’ (Smith, 1776, p. 343)

“把工作分成许多部分,使每个工人一直专做一种工作,比由一个人兼任各种工作,定需要增加不少资本。”(斯密,1776年,343页)

Therefore, as the economy developed, as productivity rose, an increasing proportion of the economy had to be devoted to investment:

随着经济的发展以及生产力的提高,经济中因此会有更大的比例用于投资:

‘As the accumulation of stock must, in the nature of things, be previous to the division of labour, so labour can be more and more subdivided in proportion only as stock is previously more and more accumulated… As the division of labour advances, therefore, in order to give constant employment to an equal number of workmen, an equal stock of provisions, and a greater stock of materials and tools than what would have been necessary in a ruder state of things must be accumulated beforehand.’ (Smith, 1776, p. 277)

“按照事物的本性,资财的蓄积,必须在分工以前。预先蓄积的资财越富裕,分工就越能按照比例分的越细密……当分工进步了的时候,雇佣工人数目不变,所必须预先储存的材料和工具,却要比没有分工进步时需要的多。”(斯密,1776年,277页)

This process of the rising proportion of investment in the economy applied to agriculture as well as to manufacturing and services. Thus Smith notes of ‘the proportion between that part of the annual produce, which… is destined for replacing a capital, and that which is destined for constituting a revenue, either as rent, or as profit’ that:

投资比例的增加不仅发生在农业,也发生在制造业和服务业。因此斯密提到“年产物中……被指定用来补偿资本和构成收益(要么是地租,要么是利润)的比例”:

‘This proportion is very different in rich from that in poor countries… at present, in the opulent countries of Europe, a very large, frequently the largest part of the produce of the land, is destined for replacing the capital of the rich and independent farmer… but antiently, during the prevelancy of the feudal government, a very small portion of the produce was sufficient to replace the capital employed in cultivation.’ (Smith, 1776, p. 334)

“这一比例在穷国和富国之间极不相同……今日欧洲各富裕国家,往往从土地生产物的极大部分用来补偿独立富农的资本……但在昔日封建政府林立的时候,年产物的极小部分已经足够补偿耕作的资本。”(斯密,1776年,334页)

Endogenous theory of innovation

创新的内生增长理论

Finally, Smith held that it was division of labour that determined technological development - not that technology was an independent factor, or that division of labour was a result of technology . Thus, in modern terminology, Smith had an endogenous, not an exogenous, theory of technological development. His conclusion on this was emphatic, and covered both proximate and ultimate causes of technological progress. Smith noted:

最后斯密认为,正是劳动分工决定了技术进步,技术不是一个独立要素,劳动分工也更加不是技术进步的产物。用现代术语来说,斯密采取了技术增长内生论而非外生论。这个结论是斯密明确得出的,它涵括了技术进步直接而又根本的原因。斯密提到:

‘The owner of the stock which employs a great number of labourers, necessarily endeavours, for his own advantage, to make such a proper division and distribution of employment, that they may be enabled to produce the greatest quantity of work possible. For the same reason, he endeavours to supply them with the best machinery which either he or they can think of. What takes place among the labourers in a particular workhouse, takes place, for the same reason, among those of a great society. The greater their number, the more they naturally divide themselves into different classes and subdivisions of employment. More heads are occupied in inventing the most proper machinery for executing the work of each, and it is, therefore, more likely to be invented.’ (Smith, 1776, p. 104)

“雇用很多劳动者的资本家,为了自身利益,势必妥当分配他们的业务,使他们生产尽可能多的产品。由于同一原因,他力图把他和他的工人所能想到的最好机械提供给他们。在某一特殊工厂内劳动者间发生的事实,由于同一理由,也在大规模社会的劳动者间发生。劳动者的人数愈多,他们的分工当然就愈精细。更多人从事于发明对各人操作最适用的机械,所以这种机械就容易发明出来。”(斯密,1776年,104页)

More generally Smith noted:

斯密还提到:

‘everybody must be sensible how much labour is facilitated and abridged by the application of proper machinery. It is unnecessary to give any example. I shall only observe, therefore, that the invention of all those machines by which labour is so much facilitated and abridged seems to have been originally owing to the division of labour.’ (Smith, 1776, p. 19)

“利用适当的机械能在什么程度上简化劳动和节省劳动,这必定是大家都知道的,无须举例。我在这里要说的只是--简化劳动和节省劳动的那些机械的发明,看来也是起因于分工。”(斯密,1776年,19页)

Smith made explicit that this analysis of the development of technology as being a result of the division of labour applied both to direct invention by users of technology and to more specialised scientific research. Thus, regarding immediate research focussed on particular industries:

斯密还明确指出,劳动分工导致的技术进步不仅体现在应用技术的直接发明,也表现在推动技术的更多专业化科学研究。因此,有关特定产业的相关研究:

‘Men are much more likely to discover easier and readier methods of attaining any object, when the whole attention of their minds is directed towards that single object, than when it is dissipated among a great variety of things. But in consequence of the division of labour, the whole of every man`s attention comes naturally to be directed towards some one very simple object. It is naturally to be expected, therefore, that some one or other of those who are employed in each particular branch of labour should soon find out easier and readier methods of performing their own particular work, wherever the nature of it admits of such improvement.’ (Smith, 1776, p. 20)

“人类把注意力集中在单一事物上,比把注意力分散在许多事物上,更能发现达到目标的更加简易更加便利的方法。分工的结果,各个人的全部注意力自然会倾注在一种简单事物上。所以只要工作性质有改良的余地,各个劳动部门所雇的劳动者中,不久自会有人发现一些比较容易而简便的方法,来完成他们各自的工作。”(斯密,1776年,20页)

More generally regarding scientific research:

更多相关科学研究:

‘All the improvements in machinery, however, have by no means been the inventions of those who had occasion to use the machines. Many improvements have been made by the ingenuity of the makers of the machines, when to make them became the business of a peculiar trade; and some by that of those who are called philosophers or men of speculation, whose trade it is not to do any thing, but to observe every thing; and who, upon that account, are often capable of combining together the powers of the most distant and dissimilar objects. In the progress of society, philosophy [in Smith’s day no specific distinction was made between science and philosophy – JR] or speculation becomes, like every other employment, the principal or sole trade and occupation of a particular class of citizens. Like every other employment too, it is subdivided into a great number of different branches, each of which affords occupation to a peculiar tribe or class of philosophers; and this subdivision of employment in philosophy, as well as in every other business, improves dexterity, and saves time. Each individual becomes more expert in his own peculiar branch, more work is done upon the whole, and the quantity of science is considerably increased by it.

“可是,一切机械的改良,决不是只由机械使用者发明。有许多改良是出自专门机械制造师之手:还有一些改良,是出自哲学家或者思想家的智慧。哲学家或思想家的任务,不在于制造实物,而在于观察一切事物,他们常常能够结合利用各种完全没有关系而且毫不相干的物力。随着社会进步,哲学或推想也像其他各种职业那样,成为某一特定阶级人民的主要业务和专门工作。此外,这种业务或者工作,也像其他职业那样,分成了许多部门,每个部门,又各自成为一种哲学家的行业。哲学上这种分工,像产业上那种分工那样,增进了技巧,并节省了时间,各人从事各人所擅长的领域,这不仅仅增加全体的成就,而且大大增进了科学的内容。”

‘It is the great multiplication of the productions of all the different arts, in consequence of the division of labour, which occasions, in a well-governed society, that universal opulence which extends itself to the lowest ranks of the people.’ (Smith, 1776, pp. 21-22)

“在一个政治明修的社会里,造成普及到最下层人民的那种普遍富裕情况的,是各行各业的产量由于分工而大增。”(斯密,1776年,21-22页)

Smith related this principle to the training of labour, that is the improvement of human capital, as well as technology:

斯密把此原则应用到了劳动培训,即劳动分工对人类资本和对技术进步的提高原理是一样的:

‘The difference of natural talents in different men is, in reality, much less than we are aware of; and the very different genius which appears to distinguish men of different professions, when grown up to maturity, is not upon many occasions so much the cause, as the effect of the division of labour. The difference between the most dissimilar characters, between a philosopher and a common street porter, for example, seems to arise not so much from nature, as from habit, custom, and education...

“人们天赋才能的差异,实际上并不像我们所感觉的那么大。人们在成年时在不同职业上表现出来的极不相同的才能,在多数场合,与其说是分工的原因,倒不如说是分工的结果。例如,两个性格极不相同的人,一个是哲学家,一个是街上的挑夫,他们间的差距,看起来起因于习惯、风俗与教育,而不是起因于天性……”

‘By nature a philosopher is not in genius and disposition half so different from a street porter, as a mastiff is from a greyhound, or a greyhound from a spaniel, or this last from a shepherd`s dog.’ (Smith, 1776, pp. 28-30)

“就天赋资质来说,哲学家和街上挑夫的差距,此猛犬与猎狗的差异,比猎狗与长耳狗的差异,比长耳狗与牧畜家犬的差异,要少的多。”(斯密,1776年,28-30页)

Econometric evidence

计量经济学的证据

Having outlined these four fundamental points of Smith’s classical theory of economic growth, it may be noted that modern econometric research has vindicated this analysis. 6 This classical theory of Smith also explains the growth of both the East Asian and the developed economies in a way that alternatives do not. The key points will be briefly considered in turn.

在概述了斯密古典经济增长理论的四个基本假设之后,值得注意的是,现代计量经济学的研究已经证实了这一分析6。斯密的古典经济学理论可以同时解释东亚和其他发达国家经济体的经济增长,而这正是其他经济理论无法实现的。接下来将会简述其主要观点。

i. Division of labour at a national level – intermediate products

国内水平的劳动分工—中间产品

Smith’s analysis of the role of rising division of labour has been strongly confirmed on the national terrain by modern econometric research - as Spengler notes, Smith analysis demonstrates that: ‘in Bohm-Bawerkian terms... production became more roundabout.’ (Spengler, 1959, p. 402). This is strongly shown by analysis of the role of intermediate inputs in production – growth of intermediate inputs being an index of increasing division of labour.

斯密分析的劳动分工这一重要角色得到了现代计量经济学的进一步确定。正如Spengler所提到,斯密的分析表明:“用Bohm-Bawerkian术语来说……生产是循环的。”(Spengler,1959年,402页)。这一结论显然可通过中间产品投入在生产中的地位体现出来,中间产品的投入是劳动分工增加的一个指标。

This econometric evidence also indicates a flaw in the original formulation of growth accounting as developed by Solow, that it identified the elements of growth as being capital, labour, plus a residual TFP, but it did not explicitly deal with intermediate inputs (Solow, 1957). The practical significance of such an omission is made clear by the econometric finding that the most rapid increase of inputs in economic growth is neither capital, labour nor TFP but intermediate products and services. Taking account of this, and sub-dividing intermediate inputs into materials, energy and service inputs led to the improved formulation of KLEMS (capital, labour, energy, materials, service inputs) methodology - see for example (Timmer, O’Mahony, & van Ark, 2007)

这一计量经济学证据还表明了索洛增长模型中原始版本中的一个错误,模型中只承认经济增长中的资本、劳动和剩余全部生产要素,但是没有清晰地提到中间产品投入这一要素(索洛,1957年)。计量经济学研究发现了这一遗漏,其实际意义在于,明确了经济增长要素投入中最快的不是资本、劳动和全要素生产率,而是中间产品和服务。考虑到这些,再将中间投入细分为原材料、能源以及服务这些要素,就形成了升级版的KLEMS模型中(KLEMS指资本、劳动、能源、原材料以及服务)。具体例子如下(Timmer, O’Mahony,和 van Ark,2007年)

Regarding factual trends for intermediate products in the most developed economy, i.e. the US, Jorgenson, Gollop and Fraumeni found these were clearly the largest source of growth for economic sectors, noting:

考虑到发达国家中产品中间投入的实际趋势,比如美国,Jorgenson, Gollop和Fraumeni发现这些中间投入正是经济部门增长中最大的来源所在,他们指出:

‘the contribution of intermediate input is by far the most significant source of growth in output. The contribution of intermediate input alone exceeds the rate of productivity growth for thirty six of the forty five industries for which we have a measure of intermediate input… If we focus attention on capital and labour inputs, excluding intermediate input from consideration, we find that the sum of contributions of capital and labour inputs exceeds the rate of productivity growth for twenty-nine of the forty-five industries for which we have a measure of productivity growth… the predominant contributions to output growth are those of intermediate, capital and labour inputs. By far the most important contribution is that of intermediate input.` (Jorgenson, Gollop, & Fraumeni, 1987, p. 200)

“至今为止,产出增长的很大一部分来源于中间投入。在我们所测量的45个行业中,中间投入的贡献超过生产率增长贡献的就占到了36个行业……同等情况下,如果我们将关注点集中在资本和劳动的输入,不考虑产品中间投入的话,我们会发现,只有25个行业中资本和劳动的投入总量的贡献超过了生产率的增长……中间投入、资本以及劳动的投入是产出的主要来源。至今为止,最重要的贡献当然是产品的中间投入。”(Jorgenson,Gollop和Fraumeni,1987年,200页)

Considering such findings for the US in more detail Jorgenson noted:

有关美国的研究,Jorgenson有进一步的解释:

‘The analysis of sources of growth at the industry level is based on the decomposition of the growth rate of sectoral input into the sum of the contributions of intermediate, capital and labour inputs and the growth of sectoral productivity… The sum of the contributions of intermediate, capital, and labour inputs is the predominant source of growth of output for 46 of the 51 industries…

“在行业水平下,分析增长来源的基础是将部门投入增长率细分到中间投入、资本以及劳动投入的总贡献和部门生产率的增长……。在51个行业,有46个行业产出贡献的主要来源是中间投入、资本以及劳动投入……”

‘Comparing the contribution of intermediate input with other sources of growth demonstrates that this input is by far the most significant source of growth. The contribution of intermediate input exceeds productivity growth and the contributions of capital and labour inputs. If we focus attention on the contributions of capital and labour inputs alone, excluding intermediate input from consideration, these two inputs are a more important source of growth than changes in productivity…

至今为止,对比中间投入与其他增长来源的贡献可以得出,中间投入是增长来源中最重要的部分。中间投入的贡献超过了资本和劳动投入的贡献以及生产率增长的贡献。如果我们将仅仅关注资本和劳动投入而不考虑中间投入的话,与生产率增长相比,资本和劳动投入的变化率是更重要的增长来源……”

‘The explanatory power of this perspective is overwhelming at the sectoral level. For 46 of the 51 industrial sectors… the contribution of intermediate, capital and labour inputs is the predominant source of output growth. Changes in productivity account for the major portion of output growth in only five industries. (Jorgenson D. W., 1995, p. 5)

“更具说服力的观点在于行业部门发展水平。51个行业中,有46个行业中间投入、资本以及劳动投入的贡献是产出增长的主要来源,剩下的5个行业中,生产率的变化是产出增长的主导因素。”(Jorgenson D. W., 1995年,5页)

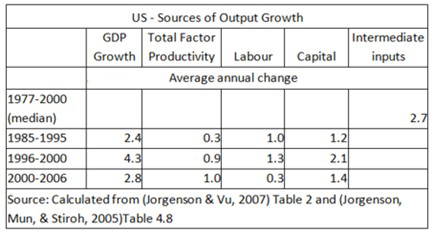

To illustrate this trend, Table 1 shows Solow growth accounting categories – capital, labour, TFP - together with the addition of a column for growth of intermediate inputs. As may be seen over the period 1977-2000 the median rate of growth of intermediate inputs in the US economy was 115% of the rate of growth of US GDP - far higher than any other input.

为了表明这一趋势,表1表明索洛增长模型核算的要素—资本、劳动、全要素生产率—再加上中间投入的增长这一栏。1977年到2000年间,我们或许可以看出,美国经济中间投入增长的平均比率是美国GDP(国内生产总值)比率的115%--增长比率远比其他要素要高的多。

Table 1

Regarding studies of rapidly growing Asian economies:

有关亚洲经济体快速发展的研究:

• Ren and Sun found for China that in the period 1981-2000, subdivided into 1984-88, 1988-94 and 1994-2000: ‘’Intermediate input growth is the primary source of output growth in most industries.’ (Ren & Sun, 2007).

• 对于中国,将1981—2000细分为1984—1988,1988—1994和1994—2000,Ren和Sun发现:在大多数行业,产出增长的主要来源是中间投入的增长。(Ren和Sun,2007年)

• For Taiwan, analysing 26 sectors in 1981-99, Chi-Yuan Liang found regarding intermediate material inputs: ‘Material input is the biggest contributor to output growth in all sectors during 1981-99, except… seven’. (Liang C.-Y. , 2007).

• 对于台湾地区,梁启源分析了1981—1999年间的26个部门,有关中间产品投入,他发现:“在1981—1999年间,除了七个部门,其他所有部门产出增长的最大贡献是原材料的投入。”(梁启源,2007年)

• For South Korea, Hak K. Pyo, Keun-Hee Rhee and Bongchan Ha found: ‘The relative magnitude of contribution to output growth is in the order of: material, capital, labour, TFP then energy.’ (Pyo, Rhee, & Ha, 2007)

• 对于韩国,Hak K. Pyo, Keun-Hee Rhee and Bongchan Ha发现:“对产出贡献增长的相关变量中,顺序依次为原材料、资本、劳动、全要素生产率,然后才是能源。”((Pyo,Rhee和Ha, 2007年)

From a theoretical point of view, therefore, the omission of intermediate inputs from the original Solow model led to errors in failing to situate division of labour as the crucial factor in economic growth - for a more detailed discussion see (Ross, 2009)

从理论的角度来看,由于忽略中间投入,最初的索洛模型产生了错误,即此模型并没有将劳动分工作为经济增长的重要因素,后面会有更详细的分析(Ross,2009年)

Considered on a national terrain Smith’s conclusion that increasing division of labour is the most fundamental source of economic growth may be considered as amply confirmed.

考虑到国土因素,正如之前充分证实的,斯密的结论是,经济增长的最基本来源是分工的增加。

ii. Division of labour at an international level

国际水平的劳动分工

Ideally, to analyse division of labour at an international level comprehensive statistical data on growth of intermediate inputs in production on a global, as well as a national, scale would be available. Unfortunately such data does not yet exist – for an analysis of steps in this direction see (Erumban, et al., 2010). Nevertheless the indirect evidence that division of labour increases at an international level is overwhelmingly strong - improbable processes would have to be postulated in order to justify any argument that international division labour was not increasing.

为了分析国际水平的劳动分工,最好能够得到国际以及各国中间产品投入的综合统计数据。遗憾的是,这些数据根本不存在,详见Erumban等人的分析(2010年)。尽管如此,国际水平的劳动分工增加的间接证据则很充分——那些认为国际劳动分工没有增加的理论,都是做了一些不切实际过程的假设。

Most fundamentally the key trends in globalisation - rising share of trade in GDP, rising ratio of foreign direct investment to GDP - plus the studies of particular industries, are powerful evidence of increasing international division of labour. There is no reason to believe that the processes creating the clearly measurable increasing division of labour on a national scale should not operate internationally - Ferreira et al, for example, have provided a theoretical analysis of such processes (Ferreira &Trejos, 2008). Smith’s point that division of labour is the fundamental issue in the effects of foreign trade, and not that of crossing national borders, remains entirely valid. The findings on intermediate inputs within national economies are therefore confirmed by processes that are evident, with lower degrees of statistical rigour, in studies of globalisation.

最根本的是,全球化的主要趋势——贸易额和对外直接投资分别占国内生产总值比率的增加,以及某些特定行业的研究结果,都是国际劳动分工增加强有力的证据。没有理由相信,那些明确衡量国内劳动分工的指标不能证明国际水平的劳动分工,例如Ferreira等人已就此过程提供了理论分析(Ferreira 和Trejos, 2008年)。斯密认为,国际贸易中的主要效应是劳动分工,而不是跨越国境本身,这点仍完全正确。各国经济中明显存在的中间产品投入,用严谨度较低的统计方法,在国际