Commentaries

Your Present Location: Teacher_Home> John Ross> CommentariesChina`s economy grows steadily amid global turmoil

By John Ross Source: China.org.cn Published: 2016-12-19

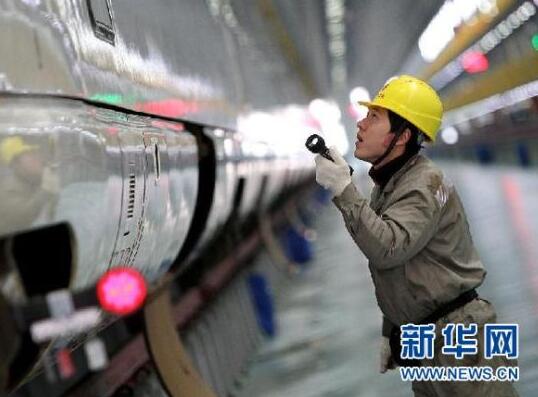

The Work Conference`s domestic context is that China`s economic growth in 2016`s last quarter was comfortably within the government`s 6.5-7.0 percent GDP growth target. [File photo/Xinhua]

China`s annual December Economic Work Conference inevitably attracted greater than usual international attention, due to the fact that it met while two powerful economic processes were occurring simultaneously: first, a positive development of China`s domestic economy in line with government targets; second, the economic storm gathering across the Pacific – the consequences of Trump`s election as U.S. president.

This article therefore looks at the context of the Work Conference, first by examining the satisfactory domestic progress of China`s economy in the second half of the year, then by the consequences for the global economy of Trump`s policies, and finally why China is able to deal with the latter.

China`s domestic economy

The Work Conference`s domestic context is that China`s economic growth in 2016`s last quarter was comfortably within the government`s 6.5-7.0 percent GDP growth target.

Following 6.7 percent GDP growth in 2016`s 3rd quarter, in January-November compared to the same period in 2015 China`s:

• Industrial value added rose 6.2 percent;

• Urban fixed investment rose 8.3 percent;

• Inflation adjusted retail sales rose 9.2 percent;

• Consumer price inflation was moderate at 2.3 percent

• A 3.3 percent producer price increase confirmed deflation had ended and created conditions for increased company profitability.

• Profits by large industrial enterprises rose by 8.6 percent.

This followed November`s year on year trade turnover increase of 8.9 percent in RMB terms.

China`s "supply side" policies since mid-year, such as reducing surplus capacity and enhancing infrastructure investment, clearly brought positive results. Claims by the Western media earlier this year that China was approaching a "hard landing" therefore appeared ridiculous. Bloomberg, for example, now analyzes "optimism" regarding China while not explaining its earlier errors.

The new challenge facing the global economy, and therefore China, is Trump`s proposed economic program – the consequences of which are more powerful than December`s Federal Reserve interest rate rise.

Trump`s borrowing program

Trump`s consequences for the global economy and China are not confined to campaign threats to designate China a "currency manipulator" and impose tariffs. Whether these are implemented is a political rather than economic decision and is not analyzed here. But the fundamental character of Trump`s proposed economic program is already clear: major tax cuts focussed on the rich plus higher U.S. military and infrastructure spending. This combination necessarily requires higher U.S. government borrowing with major consequences for the global economy – including for exchange rates, interest rates and other issues affecting China.

The international economic situation

The international context facing China`s Work Conference is that the world economy`s reality is the exact opposite of rhetoric presented in parts of the Western media of "strong growth" in the U.S. and the threat of a China "hard landing." In reality, between the first quarter of 2015 and the 3rd quarter of 2016 China`s per capita GDP growth declined only marginally from 6.5 percent to 6.2 percent, while U.S. per capita GDP growth fell by two thirds from 2.5 percent to only 0.8 percent.

Slow U.S. growth, U.S. median household incomes below 1999 levels and rising inequality explained Trump`s election. Trump in turn proposes a major change in U.S. policy, creating changes in the international economic context for the Work Conference.

Higher U.S. borrowing, interest and exchange rates

Trump`s proposed higher U.S. state borrowing and an increased demand for capital necessarily means higher U.S. interest rates unless the U.S. supply of capital can be increased – which in turn would require either increases in U.S. savings or large-scale U.S. foreign borrowing.

But U.S. domestic savings are below historic levels and recently fell. Reagan`s famous strategy to finance U.S. budget deficits was foreign borrowing, but Trump`s international circumstances differ from Reagan`s. In 1981 the U.S. balance of payments had no major deficit, whereas today it is 2.6 percent of GDP. An equivalent U.S. balance of payments deterioration to Reagan`s would mean U.S. extra annual international borrowing of $650 billion and a U.S. balance of payments deficit of 6.1 percent of GDP – higher than on the eve of the 2008 financial crisis. It is unclear whether such international resources are available for the U.S. to borrow.

However, the Economic Work Conference cannot stop the global economy from being affected by Trump`s program, leading to higher U.S. interest rates with upward pressure on the dollar`s exchange rate. Even before the Federal Reserve interest rate increase, U.S. 10-year Treasury bond yields rose from 1.83 percent on the day before Trump`s election to 2.47 percent on December 13 while the dollar`s trade weighted exchange rate rose 3.4 percent.

Such shifts can suck funds out of developing economies. Therefore, independently of what action Trump takes on tariffs, China`s Economic Work Conference had to prepare for trends negatively affecting most developing economies. Fortunately, analysis of the key risks for China shows why it can deal with them far more successfully than other countries. The fundamental reason for this is that while most economies only have demand side tools to respond to Trump`s policies, China, as President Xi Jinping has stressed, has a socialist economic structure allowing it to concentrate its key policies on the "supply side."

Exchange rate

Considering first exchange rate effects, the "supply side" is sometimes erroneously conceived of as being purely domestic. But the exchange rate, which links China`s domestic economy to the global one, crucially influences China`s supply side. Statistical studies show that the most powerful force in economic development is increasing division of labor producing greater economic efficiency. This, in a globalized modern economy, is necessarily international in scope.

China`s exchange rate rose strongly after the 2008 financial crisis. Taking into account different countries inflation rates, in October China`s real exchange rate was 32 percent above January 2008 levels – compared to the dollar`s 15 percent rise, the yen`s 3 percent decline and the Euro`s 11 percent fall. China disengaging from rises in the dollar, together with controls on its capital account and large foreign exchange reserves, gives China a much greater ability to avoid exchange rate problems than other economies.

Investment

Trump`s policies` upward pressures on global interest rates create downward pressure on investment as the latter is financed by borrowing. China`s fixed investment growth rate rose to 8.3 percent by January-November from 8.1 percent in July. However, the private investment growth rate while rising was significantly lower at 3.2 percent. Upward pressure on interest rates can negatively affect private fixed investment as this is controlled by profitability and China has not escaped upward pressure on interest rates created by Trump`s policies – the yield on China`s government bonds rose from 2.77 percent on November 7 to 3.21 percent on December 13.

However, China has two powerful mechanisms to sustain investment that do not exist in other countries. In China, most company borrowing is from banks, not bond markets, while simultaneously January-November saw a strong 20.2 percent growth rate of state investment. Therefore, there is no reason to anticipate a major fall in China`s investment.

Logistics and infrastructure

Turning from trade and international division of labor to developing China`s domestic division of labor, underdevelopment of China`s logistics system and infrastructure remains a major problem for the efficiency of China`s supply side compared to advanced economies. Per capita China`s electrical power supply, road length and railway length is respectively only 31 percent, 16 percent and 7 percent of U.S. levels. China`s supply side cannot function at the level of an advanced economy with underdeveloped logistics and infrastructure.

Therefore, China`s policy in the second half of 2016 to increase infrastructure investment should be seen not only as a successful cyclical response to the risk of slower growth but as part of its strategic program of improving China`s supply side efficiency.

Innovation and investment

The risk of downward pressure on investment could also threaten the correct emphasis China places on innovation. The lesson of periods of economic development, as illustrated by the latest stage of U.S. internet innovation, is that innovation must be embodied in fixed investment to be successful – as Alan Greenspan who headed the U.S. Federal Reserve through much of the "internet revolution" stressed. In the U.S., the correlation between growth in fixed investment and the increase in labor productivity three years later was 0.86, which is extremely high.

The increase in China`s fixed asset investment growth played a key role in stabilizing short term domestic growth in the second half of 2016. But this must be seen as part of a strategic conception that innovation can only be a successful supply side strategy for China if accompanied by a high level of fixed investment. Fortunately, as already analyzed, China has more powerful mechanisms for maintaining investment than other countries.

Conclusion

In summary, China`s December Economic Work Conference meets following successful economic performance in 2016 due to "supply side" policies. China, no more than any other country, can evade negative squalls coming out of the U.S. economy due to Trump`s proposed policies. But the context of the Work Conference is that, for reasons analyzed above, the same forces which allowed China to record economic success in 2016 give it the tools to deal with negative consequences of Trump`s policies.

The author is a senior fellow of Chongyang Institute for Financial Studies, Renmin University of China.

Key Words: China; economy; US; John Ross

京公网安备 11010802037854号

京公网安备 11010802037854号