Major Power Relations

Your Present Location: PROGRAMS> Major Power RelationsLiu Dian: Trump's old tricks won't change trade truce momentum

By Liu Dian and Wang Shoufei Source: CGTN Published: 2019-5-9

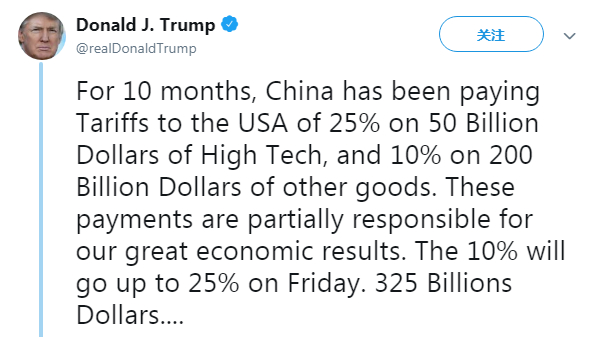

After months of negotiations, it seemed like China and the U.S. were entering the final stage of their trade talks. However, on May 5, only three days before the planned 11th round of China-U.S. talks in Washington, President Donald Trump suddenly announced that he would hike tariffs to 25 percent from 10 percent on 200 billion U.S. dollars' worth of Chinese goods.

He blamed slow progress in trade talks and explicitly rejected China's attempts to renegotiate. China vowed to retaliate if the increased tariffs go through. The sudden change in attitude on the U.S. side has once again cast a shadow of uncertainty over the China-U.S. trade relations.

CGTN screenshot of U.S. President Donald Trump's tweet.

Since March 2018 when the U.S. launched a trade war against China by imposing taxes on Chinese steel and aluminum exports, the two countries have had several rounds of tit-for-tat tariff increases as well as negotiations.

As the two sides are caught in a stalemate, China has always left the door open for negotiations. Quite the contrary, the U.S. constantly went back on its words. This has made it extremely difficult for any trade agreement to be reached, leading to the escalation of the trade spat.

Given the persistent failure of the U.S. throughout the talks to deliver on its words, the reemergence of uncertainties is nothing surprising. The U-turn in Trump's attitude looks more like a tactic designed to increase leverage and to show the "art of the deal" as a businessman. Whatever the negotiating tactics are, both countries seek to advance their own national interests. The bargaining chips at both parties' hands have not changed much and China's strategy has always been guarding the bottom line.

In December last year, after high tensions and several rounds of negotiations, Chinese President Xi Jinping and his U.S. counterpart agreed on a truce during their meeting in Argentina. Since then, the two sides have made impressive progress on issues like trade balance, protection of intellectual property and non-tariff barriers.

But there are also major issues that remain unsolved, one of them being whether to cancel current U.S. tariffs on Chinese goods. The U.S. insists on keeping in place taxes imposed on 50 billion U.S. dollars' worth of Chinese goods to make sure China deliver on its promises. Meanwhile China holds that such taxes must be removed as they have created uncertainties for Chinese investments.

Neither side is willing to budge. By asking the Chinese government to stop subsidizing high-tech companies while applying the protective policy to relevant industries of its own, the U.S. is apparently following a double standard. When it comes to tricky issues like this, an agreement is even harder to reach. Before the final "signing summit," both sides still have a lot of work to finish.

Undoubtedly, both China and the U.S. hope to see a trade deal clinched. For China, a country that intends to reform its economic system by allowing the market to play a bigger role, normal trade relations with the U.S. and sound bilateral investments are conducive to a steady economic growth.

For the U.S., although macroeconomic data shows that its economy is growing faster than expected, dividends of tax cuts would fade away in the long run, and trade protectionism would have negative impacts on its economic performance.

According to a report by the European Central Bank, the trade war might "hurt U.S. worst" in the trade war.

Based on a hypothetical scenario, the report concludes that if the U.S. increases tariffs and non-tariff barriers on all its trading partners by 10 percent, while the latter unanimously take retaliatory measures, the GDP of the U.S. may decrease by two percent during the first year of trade war, leading to a downturn of the global economy.

Trump needs a deal to end the trade war as soon as possible to secure the support of his core base and win a second term in office. The America Soybean Association has already urged the president to reach a trade deal with China as the ongoing escalations and uncertainties are "unacceptable" to U.S. farmers.

The spread of fear of a reignited trade war caused by the sudden change of Trump's attitude has led to disruption in the global capital market. After his Sunday tweet, stock markets worldwide took a hit. It is clear that the trade conflicts have significant spillover effects on global economy and financial markets, therefore the two countries should exercise greater caution in negotiations.

However, overreaction in the domestic market is unnecessary. Uncertainty is a recurring theme in China-U.S. trade talks, and due to China's active engagement in bilateral negotiations, positive progress has been made.

Trade conflicts with other countries do have negative impacts, but they are limited. With the current focus on structural reform of the economic and financial sectors, China has the confidence and means to maintain stable economic development.

Liu Dian is assistant research fellow of Chongyang Institute for Financial Studies at Renmin University of China. Wang Shoufei is an intern researcher at the Chongyang Institute for Financial Studies of Renmin University of China.

京公网安备 11010802037854号

京公网安备 11010802037854号