Major Power Relations

Your Present Location: PROGRAMS> Major Power RelationsJohn Ross: China tests its nuclear financial weapon – US markets understood, has Trump?

By John Ross Source: Guancha.cn Published: 2019-8-9

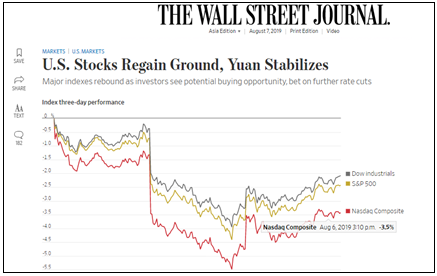

On Monday 5 August China tested an economic nuclear weapon – it allowed the RMB’s exchange rate to fall. In addition to the drop itself it took it below the psychologically important 7.0 level. Financial markets understood immediately the impact of this drop in the RMB’s exchange rate – the US S&P500 share index fell by 3% in a single day, the worst daily decline of 2019.

This sharp fall on US share markets repeated the experience following the RMB’s devaluation in 2015. The impact of China’s polices on US financial markets was analysed in detail in What are China’s most powerful weapons in economic ‘prolonged war’ with Trump?, but the effects of the 2015 devaluation may be easily summarised. John Authers, Senior Bloomberg Editor for Markets and former Chief Markets Commentator for the Financial Times, noted: ‘In the last five years, the event that scared the US market the most, by a wide margin, was the surprise Chinese yuan devaluation in 2015.’

This impact of the 2015 RMB devaluation was clear. Between 10 August and 24 August 2015, only 14 days, the RMB’s exchange rate fell by 3.0%. The US S&P500 tracked the RMB down falling by 11.2% by 25 August. In terms of current valuations of US share markets this was equivalent to a loss of $3.8 trillion.

After 5 August 2015 US share markets continued to jerk around under the direct impact of movements in the RMB’s exchange rate, or even perceived threats of movements. On 6 August the RMB’s exchange rate rose slightly and US share markets went up with it – rising 1.3% to claw back a part of the losses on 5 August.

Then on 7 August the RMB’s exchange rate was fixed slightly lower and immediately US shares futures markets dropped. Bloomberg noted: ‘U.S. stock-index futures fell as China’s central bank set its daily currency fixing at a slightly weaker level than expected… S&P 500 Index futures contracts expiring in September dropped as much as 0.5% as the yuan weakened.’

Although the RMB exchange rate fall that day was very small, and US share recovered later that day to end flat, as one commentator on Twitter noted: ‘Tuesday night: Yuan weakens by just 0.4% ... and US stock futures for Wednesday morning fall substantially. The correlation is stunning!’

This confirms the point, explained in What are China’s most powerful weapons in economic ‘prolonged war’ with Trump?, that if tariffs are the small and medium weapons in the trade war, inflicting significant but not devastating damage, US financial markets are the area hit by maximum powerful heavy weapons - due to the size of the approximately $30,000 billion US share market or the approximately $40 trillion US private and Treasury bond market. The facts confirm that movements in the RMB’s exchange rate are nuclear weapons in that market. This happens even when such movements are not directly aimed at the US but simply adjusted to international conditions, as analysed below – that is, making the comparison to a real nuclear weapon, when they are tested and not used for a direct attack, they strongly affect a war and geopolitics.

What conclusions follow from this?

The use of nuclear financial weapons

The impact on US financial markets confirms that it is the RMB exchange rate, not rare earths or tariffs, that is the most powerful weapon available to China in the trade war. But like real nuclear weapons, RMB devaluations have fallout – they can affect inflation, capital flight, other trading partners etc. Therefore, this emphasises the point made in What are China’s most powerful weapons in economic ‘prolonged war’ with Trump? analysing US financial markets that: ‘The above figures are not given to propose any specific course of action for China. The author knows that numerous factors have to be taken into account both in trade negotiations with the US and in economic policy. Some of the key pieces of information for this are known only to those involved in the negotiations. Also domestic effects of policies, not only their impact on the US, have to be taken into account. But the data is given to indicate the extreme impact of actions by China in affecting US financial markets, and therefore the sensitivity of the Trump administration to this.’

What took place on 5 August was simply that China’s Central Bank did not attempt to offset the downward market pressure on the RMB’s exchange rate created by Trump’s announcement of a new 10% tariff on $300 billion of China’s exports. But why should China use its financial strength to try to protect the US from the consequences of Trump’s announcement! US financial markets were therefore hit very severely by a normal market response without China taking any specific action against the US – except for China, in reality, refusing to subsidise the US after Trump’s announcement of a 10% tariff. That is why the correct analogy of what happened on 5 August is simply to a nuclear weapon’s test, not actual use of a nuclear weapon in war.

But everyone knows that nuclear weapons are so powerful that even their testing, without use in war, affects the geopolitical situation – that is why they are a ‘deterrent’. China’s test of its financial nuclear weapon on 5 August, as also the effect seen in 2015, was immediately understood by US financial markets and commentators – whether President Trump has understood it is considered below.

Western financial commentators mock the US response

The most important response to the RMB’s devaluation was US markets but commentators also understood clearly. They also immediately understood that the only response the Trump administration took, declaring China was a ‘currency manipulator’, was extraordinarily weak. The Financial Times analysis, published under the self-explanatory headline ‘Donald Trump sets a toothless dog loose on China’ is worth citing at length:

‘They finally did it. After decades of speculation and debate, the US Treasury late on Monday designated China a currency manipulator…

‘Making the designation now is logically incomprehensible, has no or negative practical value and merely serves to underline the US’s inability to force China to do what it wants. Apart from that, it’s a great idea…

‘Why? Because despite misinformed claims… there are no practical consequences except having the US start negotiations either bilaterally or at the IMF. Such talks in themselves will achieve nothing…

‘You could call that cowardice on the IMF’s part, or you could call it intellectual honesty….

‘The Treasury’s stated reason for the designation on Monday was implicitly that China ought to have been intervening more[to prevent the RMB exchange rate falling] rather than less. In other words, “manipulation” now simply means failing to keep the exchange rate at a level the US Treasury secretary of the day deems appropriate.

‘Even so, if the US genuinely wants a stable renminbi it has got itself into a ludicrous position. The more it threatens trade conflict through actions like this, the more downward pressure there is likely to be on the renminbi, as the currency naturally moves to offset Chinese exporters’ loss of competitiveness from tariffs. Beijing actually has little desire to let the currency slide rapidly. But the cost of holding up a falling currency becomes higher the more the US is in effect talking it down — both in financial terms from the expense of intervention and political terms from the damage of being seen to do the US’s bidding.

‘It never made much practical sense to call China a currency manipulator. In current circumstances it makes none at all.’

China experts the newsletter Sinocism, which despite wrong politics is one of the best factual sources on China in English, spelt it out equally clearly: ‘‘The RMB rumble continued overnight as the US declared China a currency manipulator, a move that is several years too late, not in accord with current reality and generally just looks weak and desperate.’

Has Trump understood yet?

China’s RMB devaluation/financial nuclear weapon’s test on 5 August was extremely accurate and well judged. If China had launched the equivalent of a full out war, that is a very large and sustained devaluation, the effects would have been so great in US financial markets that the Trump administration in desperation might have concluded it had to launch a full out attack in response. China would also have suffered possible undesirable fallout from such a large-scale action (capital flight, inflation etc) – in all-out war fallout and casualties have to be accepted but such wars should be avoided if possible. But if China had not responded strongly to Trump’s announcement of a new 10% tariff it would have appeared weak and encouraged his aggression. Instead by carrying out the equivalent of a weapon’s test Trump was warned.

Trump now faces a dilemma. The Wall Street Journal carried a very well informed article on the decision to impose the 10% tariff under the self-explanatory ‘Trump Ordered New Chinese Tariffs Over Objections of Advisers’: ‘President Trump overruled advisers to ramp up tariffs on China after a heated exchange… All of them, save Mr. Navarro, a China hawk, adamantly objected to the tariffs.’

Taking Navarro’s advice has therefore cost US share investors several hundred billion dollars. More important for President Trump personally the fallout from this for the economy reduces his chances of re-election. In short, the 10% tariff and taking Navarro’s advice was a very stupid move.

Unfortunately, Trump is capable of irrational actions. But he certainly calculates carefully regarding his own position for re-election. And China’s well-judged financial nuclear weapons test on 5 August means by now he may be beginning to understand that those who got him into the trade war with China are endangering his own position.

John Ross is a senior fellow of Chongyang Institute for Financial Studies at Renmin University of China.

京公网安备 11010802037854号

京公网安备 11010802037854号