Belt and Road

Your Present Location: PROGRAMS> Belt and RoadChina’s Belt and Road: Destination Europe

By Bruno Maçães

In two separate speeches in fall 2013, Chinese President Xi Jinping put forward a bold new development strategy encompassing more than 60 countries across Asia, Europe, and East Africa and totaling investments estimated to be in the trillions of dollars.

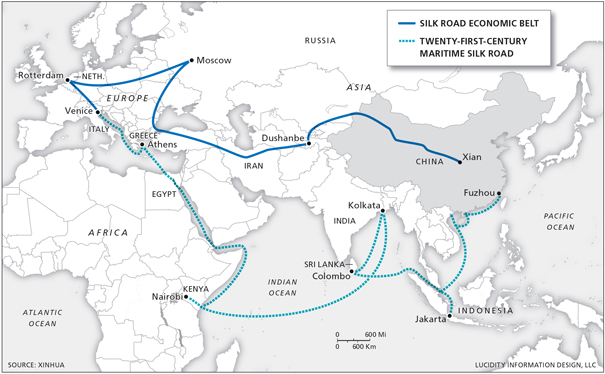

The initiative has a land and a sea component, known respectively as the Silk Road Economic Belt and the Twenty-First-Century Maritime Silk Road. The preferred abbreviation in China for the combined initiative is Belt and Road, also called One Belt, One Road, while outside the country it is often referred to as the New Silk Road. Unlike the original Silk Road, however, the new project is not predominantly about transportation infrastructure but about economic integration. The initiative does not attempt to unbundle production and consumption—the vision of the original Silk Road—but rather to unbundle different segments of the production chain. It attempts to create a set of political and institutional tools with which China can start to reorganize global value chains and stamp its imprint on the rules governing the global economy.

Europe cannot ignore this landmark Chinese project. How the European Union reacts to the initiative will have a decisive impact on what model of economic integration will be adopted across the borderlands dividing Europe and China and, eventually, in the Eurasian supercontinent as a whole. Europe’s response to the Belt and Road should pursue a multipronged strategy of bargaining, containment, and balancing, as this is the most appropriate way to promote European interests and values.

AN ECONOMIC PROJECT?

Commentaries and analyses of the Belt and Road Initiative have made frequent reference to the Silk Road, the old camel-powered network of routes that linked Europe and Asia from the time of the Parthian Empire until the beginnings of the modern age. In official Chinese statements, such allusions no doubt try to capitalize on the evocative associations the name carries and a sense that China, the discoverer and keeper of the secret of silk manufacture, was also the great power fueling and protecting early Eurasian integration.

Nevertheless, these references have helped create an impression that the new initiative is ultimately about transportation infrastructure. Many observers have reacted with perplexity to this notion. After all, if China were seeking to expand and revamp port facilities in the Pacific and Indian Oceans, this may make a lot of economic sense but would hardly be revolutionary.

Conversely, if the real core of today’s initiative were its land component, the Silk Road Economic Belt, and if its goal were to replace sea cargo transportation with a new network of roads and railroads across the Central Asian steppes, deserts, and mountains, such a project would indeed be a revolution—but one with no economic viability whatsoever. Rail transportation, even if faster than maritime shipping, will always be significantly more expensive, and few economists believe that transportation costs are a significant obstacle to the expansion of global trade.

Being received outside China in such a way, the Belt and Road acquired a considerable element of mystery. China watchers wondered what the new project might be for, what the official statements were eluding, and why Beijing would launch a giant political initiative whose economic rationale remained at best doubtful. Was it designed as a marketing ploy? Or was it perhaps to be explained according to the arcane tenets of that old discipline, geopolitics?

In my conversations with Chinese officials and experts, the recurring message is that to interpret the Belt and Road in geopolitical terms is to miss the point. There are several reasons why the Chinese authorities are now making a coordinated attempt to salvage the initiative from the logic of power rivalry and competition.

First, the Chinese authorities know that allowing the Belt and Road to be captured by such a logic would make the project’s realization much more difficult or even, in its most ambitious versions, impossible. A geopolitical reading of the initiative would set off alarm bells in Russia and the United States and create resistance from the countries along the new routes, upsetting the delicate balance that is needed to prevent a complex plan with many different connecting parts from falling apart.

Second, many analysts in China, especially in universities, consider geopolitics and the idea of great-power rivalry a Western cultural product that China can do without.

Third, the main goal of Chinese policymaking will for a long time remain to advance economic growth and development. Anything else will be a distraction from the essential, practical objective of extracting maximum economic benefit from the Belt and Road.

It is hardly surprising, therefore, that the only official Chinese document expounding the general vision for the initiative entirely shuns geopolitics, even in the milder forms of expanding Chinese soft power. Issued in March 2015 with the clunky title “Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road,” the paper offers a vision of greater economic integration between mutually complementary economies. Such integration is meant to promote the “orderly and free flow of economic factors, highly efficient allocation of resources and deep integration of markets.”

These references are important clues that the ultimate purpose of the Belt and Road Initiative is deep economic integration through the development of global value chains. Importantly, the initiative is supposed to abide by market rules. Either geopolitical considerations were never taken into account or everything in the Vision and Actions document was carefully checked and revised to make it read like a business plan.

Nevertheless, while shunning geopolitics, the document develops a theory of economic integration that strongly relies on political power. The most ambitious statements probably concern economic policy coordination: “Countries along the Belt and Road may fully coordinate their economic development strategies and policies, work out plans and measures for regional cooperation, negotiate to solve cooperation-related issues, and jointly provide policy support for the implementation of practical cooperation and large-scale projects.”

The Chinese authorities, steeped in Marxist theory, are familiar with the idea of a world system articulating the relations of economic power and dependence at the heart of the global economy. Patterns of specialization and comparative advantage determine the place each country assumes in the global economy and, as a result, the levels of absolute and relative prosperity it may hope to achieve. The global economy is less a level playing field than an organized system in which some countries occupy privileged positions and others, such as China, try to rise to these commanding heights.

Chinese decisionmakers share with their Western counterparts the premise that economic and financial globalization has made it difficult for a single country to pursue a specific economic vision. But the Chinese are less inclined to renounce all forms of economic planning than to redefine the rules of the globalization game. A priority identified in the Vision and Actions document is to improve the “division of labor and distribution of industrial chains.” When it comes to the division of labor along the value chains of industrial production, positions and preferences that reflect the national interests of countries in the regions of the Belt and Road may differ or even contradict each other. In such cases, observers should be under no illusions that China, as the promoter of the initiative, is uniquely placed to pursue its interests.

THE BELT AND ROAD AND GLOBAL VALUE CHAINS

Patterns of international specialization and division of labor are particularly relevant in the age of global value chains. Today, very few products are manufactured in a single country. A country’s manufacturing imports are more likely to be intermediate goods—that is, commodities, components, or semifinished products that a country uses to make its own products. These could be final products or new segments in a global network of producers and suppliers. Global value chains can become so complex that imports can also contain returned value added that originated in the importing country. In China, nearly 7 percent of the total value of imported intermediate goods reflects value added that originated in China. For electronic goods, Chinese intermediate imports contain over 12 percent of returned Chinese domestic value added.

With the emergence of global value chains, the mercantilist approach that views exports as good and imports as bad starts to look counterproductive and even self-contradictory. If a country imposes high tariffs and obstacles on the imports of intermediate goods, its exports will be the first to suffer. As a number of studies by the Organization for Economic Cooperation and Development have shown, nominal duties on gross exports are an incomplete measure of effective tariff barriers. The effective burden for the exporter is better measured by tariffs on the domestic value added of exports, and these tariffs can be larger than duties on gross exports by several orders of magnitude.

Domestic firms therefore need reliable access to imports of world-class goods and service inputs to improve their productivity and ability to export. In this new age, it pays to think across national borders. When intermediate inputs tend to cross borders many times, even small tariffs and border bottlenecks have a cumulative effect, and protective measures against imports increase the costs of production and reduce a country’s export competitiveness.

These are all good arguments for trade liberalization, but consider what happens to a country’s ability to organize production along the most efficient lines. If goods are produced entirely in one country, that country has full control over the whole process. Once goods are produced in several countries as the combined result of an intricate division of labor in each value chain, things become tricky. What a country wants is to pick and choose the best segments in each value chain. Industrial policy increasingly targets tasks rather than industries, but for that, a government would have to gain access to the levers of industrial policy in other countries, to be able to organize production across the whole value chain. A country has a lot more to gain by moving into higher-value segments in a supply chain than by increasing productivity in an already-occupied segment.

Therefore, if China wants to focus on certain segments of a given value chain, it needs high levels of complementarity in other countries. These will develop only if the right transportation and communications infrastructures have been put in place and if those countries adopt the right economic policy decisions. One Chinese expert told me that the Belt and Road Initiative is the first example of “transnational” industrial policy. “Formerly, all industrial policy was national,” he said. He has a point, as even the European Union, when it created an ambitious transnational framework of rules and institutions, tended to abandon industrial policy on the grounds that such a policy could not be reproduced at a transnational level. This points to the clash between different integration models.

The image of the original Silk Road is particularly misleading in this context, as indicated by the inclusion of the small code words “belt” and “road” in the names of the project’s two components. The land element is called a belt to pinpoint that its ultimate goal is the creation of a densely integrated economic corridor rather than a transportation network linking two points. The maritime road is meant to adapt sea transportation to new patterns of global trade.

Transportation and communications networks are no doubt a precondition for the development of global value chains. But the crucial element is the set of industrial policy decisions by which countries strive to move into new chains or segments in an already-occupied value chain. To avoid the middle-income trap—a situation in which a country becomes stuck with its previous growth model after attaining a certain level of income—and speed up the process of moving into higher-value segments, China wants its industrial policy to be sufficiently coordinated with those of countries that occupy other segments and chains. In return, China can offer cheap financing and its experience of an economic model that has proved very successful in boosting industrialization and urbanization on an unprecedentedly fast timescale.

In practice, Chinese industry may need reliable suppliers of parts or intermediate goods, or it may attempt to build assembly plants overseas to avoid import tariffs, while keeping the bulk of the production chain in China. It may try to create new opportunities to export raw materials or intermediate goods produced in China or, conversely, to secure raw materials for its own industry on a stable basis. Given how important services have become to the integrity of global value chains, increasing service exports will also be a strategic goal for the Belt and Road.

Take the case of the steel industry. Hit by falling steel prices, the performance of China’s steel industry has been sharply decreasing. The industry generated a sales revenue of 7.2 trillion yuan ($1.1 trillion) in 2015, down 13.9 percent on the previous year, and a total profit of 97.2 billion yuan ($14.3 billion), down 60 percent. Chinese policymakers are aware that some of the industry will have to move abroad, and they have started looking at Central Asia, with its lower production costs, as a possible destination. As governments and the private sector in the region invest in energy development, transportation infrastructure, and residential construction, the demand for steel products in Central Asia is expected to boom in coming years, but Chinese producers have to compete with Russian, Turkish, and Ukrainian steel enterprises that benefit from easier trade regimes. These competitors would lose that advantage if Chinese companies established steel production units in Central Asian countries, which are rich in mineral resources and have low labor costs. In the integrated framework of the Silk Road Economic Belt, new transportation infrastructure could both boost demand for steel and prepare the ground for China to import steel from Central Asia as it moves into higher-value products and value-chain segments.

Put simply, transportation infrastructure plays an ancillary role to financial, trade, and industrial policy integration. This notion comes across in almost every paragraph of the Vision and Actions document as well as in many technical papers published since 2014 by different Chinese ministries.

China’s focus on land routes may seem counterintuitive. From port to port, sea freight will always be cheaper than overland transportation. Industry trends point toward ever-lower prices as container shipping rates break historic lows. The largest carriers continue to add new megaships to their fleets, with orders placed years ago to be delivered whether companies now want them or not. In this environment, it would be ludicrous to expect new railroads to make much of a dent in long-distance cargo transportation. Still, in a context of historically low freight prices, new opportunities to develop complex global value chains are being created, and existing value chains are reconfigured on land, not on sea, through the opening of new industrial parks. When the Chinese Communist Party’s official organ Qiushi looked into the early successes of the Belt and Road, it underlined the construction of 46 new such industrial zones.

More recently, China has openly advocated the importance of a common development model reached through political consultation. The first progress report on the Belt and Road Initiative, authored by Renmin University and published in September 2016, concluded that “significant progress has been made on the Initiative in terms of its top-level design, policy coordination, facilities connectivity, unimpeded trade, financial integration, [people-to-people bonds] as well as China’s local efforts.” The report went on to argue that “an array of key projects is underway, with a commitment to achieving common development and shared growth through joint consultation. China, together with countries and regions along the Belt and Road routes, is building a green, healthy, intelligent and peaceful Silk Road, which is creating momentum for growth in these economies as well as bringing about great opportunities for shared development.”

THE EU’S REACTION TO THE BELT AND ROAD

The impact of the Belt and Road project on the European economy is widely thought to be slight—likely positive if the initiative is focused on improving transportation infrastructure, modestly negative if trade integration with China reduces European exports to Central and South Asia. Yet this view ignores both the ambition and the long-term impact of the project, once its purpose has been properly understood.

So far, the EU has made little effort to actively develop a common position on the project. The debate on the issue in European circles has been poor and almost exclusively of a technical nature. To link investment strategies, avoid duplications, and explore possible synergies, the European Commission has created a technical connectivity platform. A document entitled “Elements for a New EU Strategy on China,” published by the commission in June 2016, mentions the Belt and Road only in a couple of brief passages, and then to affirm that “the aim should be to help build sustainable and inter-operable cross-border infrastructure networks in countries and regions between the EU and China.”

The way the EU should react to the Belt and Road project of greater Eurasian integration depends very much on how Europeans interpret that project. If the initiative were seen through the misguided lens of pure transportation and communications infrastructure, it would be appropriate for the EU to embrace it with few or no reservations. Such an initiative would adhere quite closely to the EU’s own strategic goals of furthering connectivity, reducing obstacles to international trade and exchange, and helping bring different cultures and countries closer together.

A 2016 report by the European Council on Foreign Relations titled “Absorb and Conquer” goes so far as to argue that just by adopting the Belt and Road strategy, China has already given the game away, in the sense that it has accepted the EU’s integration model based on institutional frameworks and comprehensive legal agreements. “Simply by embarking on broad, multilateral integration efforts,” the authors wrote with reference not only to the Belt and Road but also to the Eurasian Economic Union, “the Chinese and the Russians have chosen to compete on the EU’s terrain.” Of course, the authors then admitted, China’s projects will also attempt to rival the EU’s, but because the former are merely copies, the European model will win out in the end. In European eyes, all roads lead to Brussels, even the Belt and Road.

But the Belt and Road is not a transportation and communications project, and its success will not be measured by a quantitative index of connectivity speed. Rather, the initiative attempts to change the rules organizing the global economy, primarily by granting China a set of tools with which it can reorder global value chains. Until now, these value chains have been coordinated predominantly by large multinationals through complex webs of supplier relationships and various governance modes including direct ownership of foreign affiliates.

European countries have benefited enormously from being home to some of these multinationals. But the question they face is not primarily about the losses they will incur when Chinese companies start to be better represented in high-value segments of important value chains. The main question is what set of rules will govern the way these chains are organized.

The Chinese model is to conduct this organizing process as much as possible at the political level, through agreements reached directly between national governments. Most large Chinese multinationals are not simply state owned but are effectively managed with a view to goals and strategies defined outside the company and through political channels. Some of these companies make this clear when they avoid facing lawsuits by claiming sovereign immunity. Aviation Industry Corporation of China, a state-owned aerospace and defense firm, used this immunity twice in just one year.

Most analytic work on global value chains is still recent, and there is still a lot to learn about the most efficient and fairest way to organize them. Existing models may all prove ultimately flawed, but it would be naive to think that there is no question about rival models struggling for predominance or that China’s Belt and Road is not a particularly bold gambit to shape that fundamental struggle in a certain way. When the EU reduces its reaction to the initiative to the technical issue of linking European and Chinese projects in a connectivity platform designed to enhance economic synergies, it is ignoring the deeply political question of what model of Eurasian integration should prevail, or what combination of different models can be agreed on. For example, while Chinese authorities often speak of a principle of noninterference, they mean noninterference in the state’s ability to pursue collective goals, rather than the liberal notion of noninterference in individual life plans. For China, industrial policy—the channeling of industrial development and innovation in predetermined directions—is the crux of economic policy; this is an approach that few if any European policymakers now believe in.

The question of different political and economic models is one that only power, influence, and leverage will be able to decide. For its part, the EU should adopt a multipronged strategy of bargaining, containment, and balancing.

Bargaining means that the EU should adopt a negotiating position that effectively tries to redress the asymmetry whereby Chinese firms are free to buy stakes in European companies but European firms remain locked out of Chinese capital markets. If China wants to benefit from recognition as a market economy, it will need to gradually change some of the fundamental elements of its economic culture, notably those that stand in the way of any meaningful distinction between political and economic power.

Containment means that the EU must increase its presence in countries that play the decisive role of gateways and connecting nodes along the new routes linking Europe and Asia. At present, both Russia and China are actively engaged in preserving or expanding their influence in countries like Azerbaijan and Kazakhstan, while the EU tends to make its presence contingent on unrealistic demands for political transformation. Ambitious investment treaties with a select number of countries would open the door to greater investment in both directions and to asset swaps, which affirm an important European value: diversification away from economic dependence on a single actor.

Finally, balancing means that the EU should be able to influence developments in China by moving ahead with other free-trade agreements with global actors like India, Japan, and the United States. The norms and standards resulting from these agreements will have enormous weight in China and may be able to preempt China’s efforts to effectively export its economic culture to the periphery and, ultimately, the Eurasian supercontinent as a whole.

The fact that the initial focus of the Belt and Road is on China’s immediate periphery should not blind observers to the fact that Europe is its final destination. That notion is conjured up by the use of a name—the New Silk Road—whose associations recall the old trade networks linking the Atlantic to the Pacific. This name is in many respects misleading, but it does have the advantage of reminding China watchers that the Belt and Road is above all a challenge to Europe—a challenge to which Europeans have yet to respond.

Bruno Maçães is a nonresident associate at Carnegie Europe. His research focuses on EU integration and foreign policy, trade policy, and broader globalization trends.

Key Words: China; Belt and Road; Europe

京公网安备 11010802037854号

京公网安备 11010802037854号