LATEST INSIGHTS

Your Present Location: LATEST INSIGHTS[SCMP] Zhao Xijun: China’s construction for Indonesia’s new capital Nusantara to lead growing overseas city-building portfolio

Source: SCMP Published: 2024-03-24

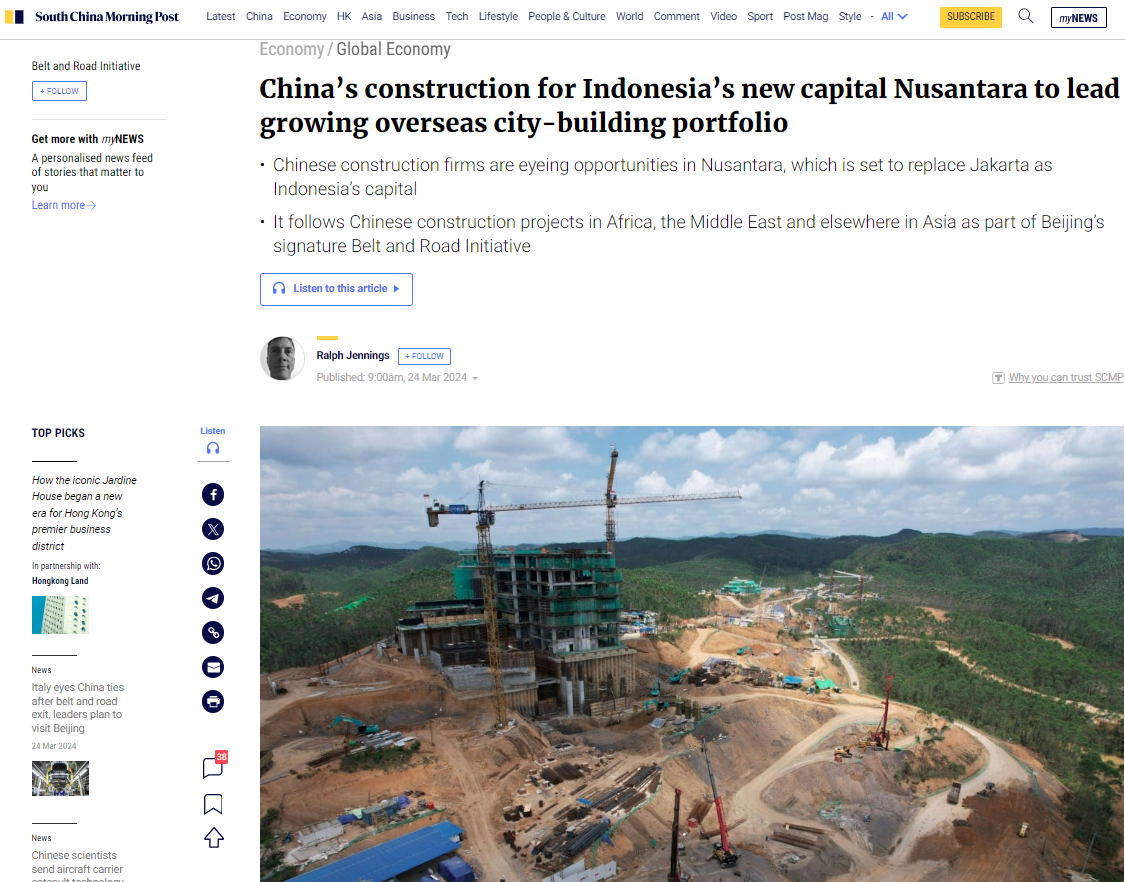

China is positioning itself to become one of the top foreign investors in Nusantara, the planned new capital of Indonesia that is being built from scratch over the next 20 years in the middle of forests and palm tree farms.

The investment is expected to become the stand-out showpiece in a growing body of work building smart cities and other landmark urban zones in other countries, analysts said.

The projects in turn would help China connect with friendly nations to facilitate trade, they added, giving Chinese construction firms a chance to prove themselves abroad.

“It’s fair to say that China has the strongest squad of engineers and constructors, who have benefited from the country’s building boom since the mid-2000s,” said Xu Tianchen, a senior China-based economist with the Economist Intelligence Unit.

“China is also experienced in providing full life cycle solutions, from financing to construction and maintenance, which make life easier for host countries.”

Beijing-based state-owned builder Citic Construction has expressed interest in developing 60 residential towers in Nusantara, which is set to replace flood-prone Jakarta as the national capital.

The move had been delayed due to the coronavirus pandemic, but government offices may be relocated this year as officials seek to reduce the burden on Jakarta.

“I’m not surprised that China will invest a lot in Indonesia, including [Nusantara], because the Indonesian minister of investment has said that doing business with China is easy and they are not fussy about asking for various requirements like other countries,” said Nukila Evanty, a Jakarta-based member of the Asia Centre research institute’s advisory board.

Building cities for other countries also naturally follows China’s 45-year “leap” in its own urban development, as well as the goals of its Belt and Road Initiative, said Victor Gao, vice-president of the Centre for China and Globalisation in Beijing.

Beijing’s signature Belt and Road Initiative has spawned China-funded infrastructure projects in scores of countries, including ports, highways and power plants.

Construction of smart cities – a term that usually refers to technology-aided management of traffic and urban resources – advances China’s goal of increasing “connectivity”, especially in countries near its borders such as in Southeast Asia, Gao said.

Chinese-funded projects in Nusantara – which is located on the east coast of the island of Borneo – would follow work in Africa, the Middle East and elsewhere in Asia.

In Egypt, Chinese contractors built much of the New Administrative Capital government centre, Egyptian Hong Kong-based consul general Baher Sheweikhi previously told the Post. The new capital includes one of the African nation’s tallest skyscrapers.

Several Chinese companies are also helping construct Egypt’s New Alamein, a city designed to accommodate autonomous shared cars and public transport systems, Xu added.

China is also taking part in the construction of Neom in Saudi Arabia, which officials call a “futuristic” development. Chinese firms have worked on tunnels, solar power stations and water desalination projects, Xu said.

In 2019, China and Kenya signed a US$665 million deal to help build “smart cities” in the African nation, with Chinese telecommunications equipment giant Huawei Technologies nominated to carry out the work.

And in 2020, Alibaba Cloud – Alibaba Group Holding’s cloud computing unit – received clearance in 2020 to install hardware for Kuala Lumpur’s smart city system that is designed to collect and integrate real-time data from traffic cameras. Alibaba is the owner of the South China Morning Post.

China already ranks as Indonesia’s second-largest investor after Singapore following a steep climb over the past decade, with combined direct investment from mainland China and Hong Kong in 2023 of US$13.9 billion.

“Chinese construction companies are increasingly competitive worldwide, in terms of expertise,” said Zha Daojiong, an international studies professor at Peking University.

And while countries have their own property developers, Chinese firms may carry out higher-quality work, Gao added.

The output value of China’s construction industry topped 31 trillion yuan (US$4.3 trillion) in 2022, according to People’s Daily.

The projects in Nusantara are also significant for China because Indonesia is Southeast Asia’s largest country, a member of the Regional Comprehensive Economic Partnership trade pact and an original member of the Belt and Road Initiative, said Zhao Xijun, a finance professor at Renmin University in Beijing.

And a US$7.3 billion, 142km (88 mile) high-speed railway built by a Chinese-invested consortium on the populous island of Java, which opened last year, should be seen as a “model” for what China can do, Zhao added.

“That’s a very successful cooperation project in terms of investment in Indonesia,” Zhao said.

The Nusantara Capital City Authority estimated that domestic firms have committed US$2.2 billion toward building the future capital versus a total cost of about US$30 billion – leaving plenty of space for foreign investors.

But Chinese investments in the development of foreign cities comes with risks of delays, overruns, financing and social stability, analysts added.

Officials in Beijing are watching Belt and Road Initiative partners for any “country-specific risks”, linked to economic trends and social stability, Zhao said, although Indonesia is considered “low risk”, he added.

But China would still stay on alert for “significant delays and cost overruns” on the Indonesian capital construction projects, Xu said.

Chinese contractors experienced delays and overruns on the Java high-speed railway, he added.

He said some Indonesian citizens and officials already resent China over past disputes over mining projects.

Beijing’s role in Nusantara would face particular scrutiny if the Indonesian government provides the public little information about Chinese investment, Evanty added, pointing to a perception that Chinese workers take jobs away from locals.

“A few people tend to be xenophobic towards workers from China, especially in disadvantaged areas where unemployment and poverty are high and where there is Chinese investment,” she said.

Key Words: Zhao Xijun, Indonesia, Investment

京公网安备 11010802037854号

京公网安备 11010802037854号