LATEST INSIGHTS

Your Present Location: LATEST INSIGHTSA-shares end higher on Tuesday as China acts swiftly to ensure stock market stability

Source: Global Times Published: 2025-04-08

By Song Lin

Reporter of Global Times

After global markets were hit by a "Black Monday" sell-off, China's financial regulators acted swiftly to calm investors, while the state-backed "national team" decisively stepped in, injecting both capital and confidence. All three major A-share indexes closed higher on Tuesday.

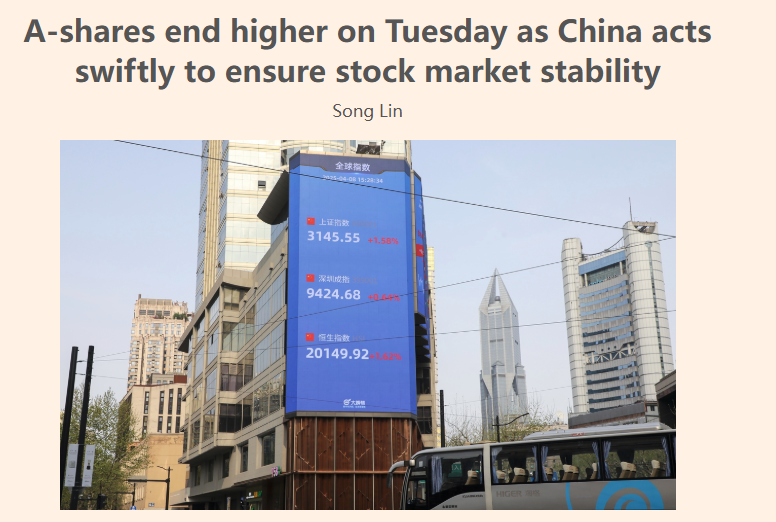

At the close, the Shanghai Composite Index was up by 1.58 percent, reclaiming the 3,100-point mark, the Shenzhen Component Index gained 0.64 percent and the ChiNext Index ended up 1.83 percent.

Hong Kong's major indices also rebounded collectively. At the close, the Hang Seng Index was up by 1.51 percent, while the Technology Index surged by 3.79 percent.

After issuing a statement on Monday during market hours, expressing confidence in the long-term prospects of China's capital markets and announcing further purchases of exchange-traded funds, Central Huijin, a state-owned investment company, reiterated its stance before the markets opened on Tuesday. It emphasized its commitment to acting as a stabilizer in the market, pledging to "step in decisively when necessary to curb abnormal fluctuations."

Central Huijin has long been a key strategic force in maintaining the stability of China's capital markets, often referred to as the "national team" in the market, playing a role similar to that of a stabilization fund, the state-backed investor said in a statement.

Also on Tuesday morning, the People's Bank of China, the central bank, said that it firmly supports Central Huijin in increasing its holdings of stock market index funds, and will provide the investor with sufficient re-lending support when necessary, resolutely maintaining the smooth operation of the capital market.

"Given the actions and determination of the national team, it is expected that the A-share market will stabilize and rebound after a short-term emotion-driven correction. Additionally, some high-quality stocks are already trading at historically low valuations. Overall, both A-shares and Hong Kong stocks are valued at only about one-third of US stocks, meaning the current market valuations are favorable," Yang Delong, chief economist at Shenzhen-based First Seafront Fund, told the Global Times on Tuesday.

The National Council for Social Security Fund (NCSSF) also on Tuesday reaffirmed its commitment to long-term, value-based and responsible investing. Recently, the NCSSF has increased its holdings in domestic stocks and plans to continue doing so, according to a statement released by the fund.

Also, the National Financial Regulatory Administration announced on the same day that it had issued a notice on adjusting the regulatory ratio of insurance funds' equity assets. It included measures such as raising the equity investment ratio by 5 percentage points for certain solvency ratio tiers, expanding the room for equity investment and providing more equity capital to the real economy.

The rebound in the stock market is sustainable and is expected to continue, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China, told the Global Times on Tuesday.

"China is committed to developing its own economy and maintaining normal trade relations with other partners. This will enable China's economy to maintain steady growth, which is the fundamental foundation for the positive performance of the stock market," Dong said.

In a note sent to the Global Times on Tuesday, Switzerland-based UBS estimated that in 2025, apart from the "national team," other long-term investors may enter the A-share market in a sustainable and stable manner under the guidance of the regulators. The investment bank forecasts net inflows into China's stock market from Chinese mainland insurance companies amounting to 1 trillion yuan ($137 billion), mutual funds at 590 billion yuan and the social security fund at 120 billion yuan.

Meanwhile, dozens of Chinese listed companies have rolled out share buyback and stake increase plans.

Contemporary Amperex Technology Co, the leading battery maker, said on Monday night that it plans to repurchase shares worth between 4 billion yuan and 8 billion yuan using its own or raised funds, with the buybacks to be conducted via centralized bidding.

Seven listed companies under China Merchants Group, including China Merchants Shekou, China Merchants Port and China Merchants Expressway, issued statements before the market opening on Tuesday, announcing plans to accelerate their share repurchase programs.

China's comprehensive industrial supply chain and vast consumer market underpin the strength of its economy, and US tariff threats do not alter the country's positive economic fundamentals. The recent pullback in the undervalued A-share and Hong Kong markets presents a favorable entry point for long-term investors. The revaluation of Chinese assets that began earlier this year is likely to continue after this round of adjustment, Yang said.

Key Words: Dong Shaopeng, RDCY, stock market, stability

京公网安备 11010802037854号

京公网安备 11010802037854号