Picture

Your Present Location: HOME> PictureRDCY: China’s overall debt level should not be overestimated

On October 13th, 2021, Macro Situation Forum (Fall 2021) with report release of “An Analysis of China's National Debt Level Using Two Leverage Ratios”, hosted by Chongyang Institute for Financial Studies, Renmin University of China (RDCY), co-organized by Global Governance Research Center at Renmin University of China and Jufeng Financial Research Institute, is held successfully. CCTV, Changan Street Zhishi, iFeng.com, Nanfang Metropolis Daily, Shenzhen TV, Security Times, Zhonghong.com, Financial News report the event.

Since earlier this year, as President Xi Jinping emphasized on “Tell China’s Stories”, it has become more and more popular and widespread in the Chinese society. As a response to the appeal, this report is not only a part of the Marco Situation series, but also the second and newest installation of “Tell China’s Economic and Financial Stories” report series. RDCY elaborates and explains a new research completed on China’s debt level, which is a major focus of the academia and the market, through the lenses of “income leverage ratio” and “asset leverage ratio”. The report is released with a title of “It Should Not Be Overestimated --- An Analysis of China's National Debt Level Using Two Leverage Ratios” (“the Report”), which was lead authored by Liao Qun, Chief Economist of RDCY and Chief Specialist of Global Governance Research Center.

The report first reviews the rationale of the two leverage ratios. It believes the income leverage ratio (total debt to GDP), which is the mainstream focus, and the asset leverage ratio(total debt to total asset), which is less applied, measure the national debt level from two different perspectives. The report admits both perspectives have their own distinct logic. However, the national debt is made up of the debt levels of each macroeconomic sectors in the country, and the logic intensity of the "flow perspective" and the "stock perspective" vary by economic sectors: the former is stronger for government and household sectors, and the latter is higher for corporate sector.

The report emphasized the importance and complexity of the corporate debt level, as well as the reasonableness of the two leverage ratios for measuring the debt level for the corporate sector. The report finds that the debt level of corporate sector is quite high through the lens of income leverage ratio. In 2019, China overall income leverage ratio was 246.5%, indicating that the total debt is 2.47 times the GDP of that year. By macroeconomic sectors, China's corporate, government, and household income leverage ratios were 151.9%, 38.5% and 56.1% respectively in the same year. According to international comparisons, China’s income leverage ratio is overall on the high side, and significantly higher than other countries for the corporate sector. (see figure below)

The report explores the causes behind the above facts. Four justifiable causes include a large share of "heavy economy" in the whole economy, a high saving/investment rate, dominance of debt financing, and high growth expectations. For example, equity occupies about 70% of total debt in the United States, about 55-60% in Eurozone, UK and Japan, all much higher than China’s 5%. Four non-justifiable causes include the over-representation of state-owned enterprises, overdevelopment and overcapacity for some industries, rapid expansion of local governments' hidden debts, and excess liquidity in the market. For instance, the state-owned economy is about 10% for world average, less than 5% for advanced economies, while China has a proportion of 28% and SOE composed 21% of industrial value-added. What must be recognized is that the four justifiable causes reflect a certain number of essential features of China's economic structure and financial market at the present stage, and the resulting high income leverage ratio of the corporate sector is determined by the nature of the current debt demand, which does not indicate that the corporate debt level is too high. In contrast, the four non-justifiable causes reveal the current shortcomings of the country’s economic structure and financial market and the higher income leverage ratio caused by them exceed what the debt demand nature at the present stage calls for, and hence it does truly indicate an excessive level of corporate sector’s debt level. That is to say, because of the existence of the justifiable causes, the income leverage ratio tends to overestimate the debt level of the corporate sector.

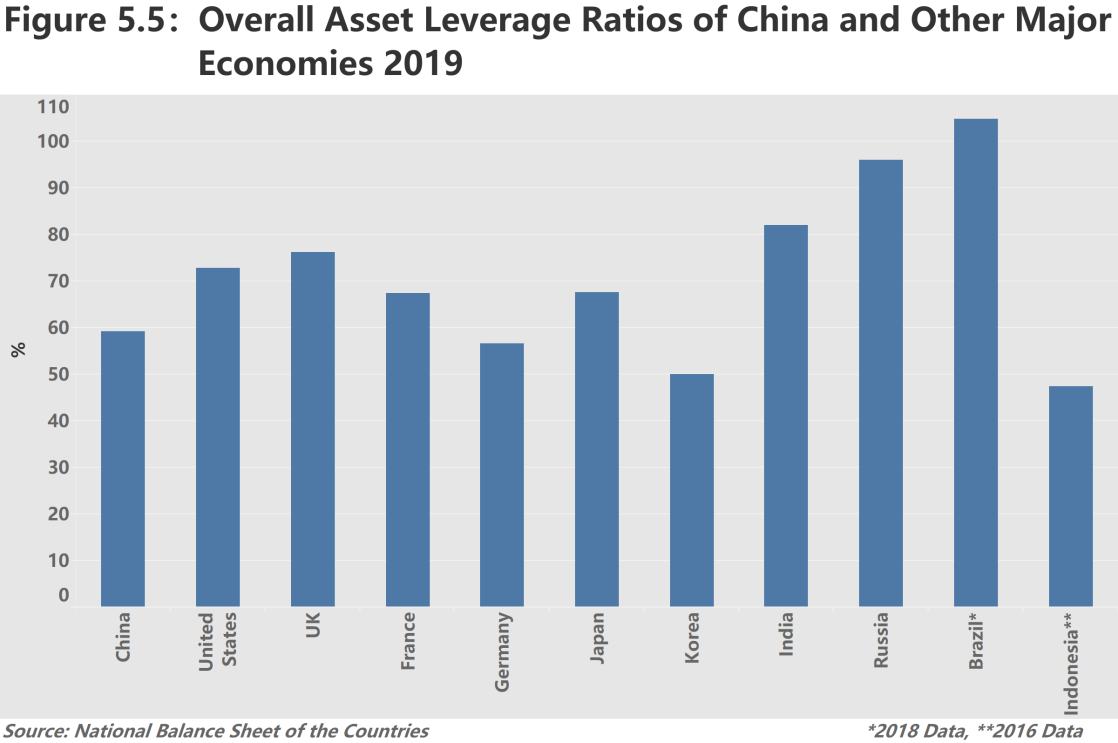

The report also finds that through the lens of asset leverage ratio, China’s debt level would not be considered high, whether overall or in different sectors (corporate, household and government). The asset leverage ratios of the nation and its government, household, and corporate sectors were 59.2%, 18.9%, 10.8%, and 60.2% respectively in 2019. The average asset leverage ratio of non-financial listed companies was 60.8% at the end of 2019 in China, which hardly differs from the 60.2% corporate asset leverage ratio in the national balance sheet. According to international comparisons, China’s overall asset leverage ratio is in the middle (see figure below), and the corporate sector is relatively low. Therefore, the asset leverage ratio and the income leverage ratio will lead to different results on measuring China’s debt level.

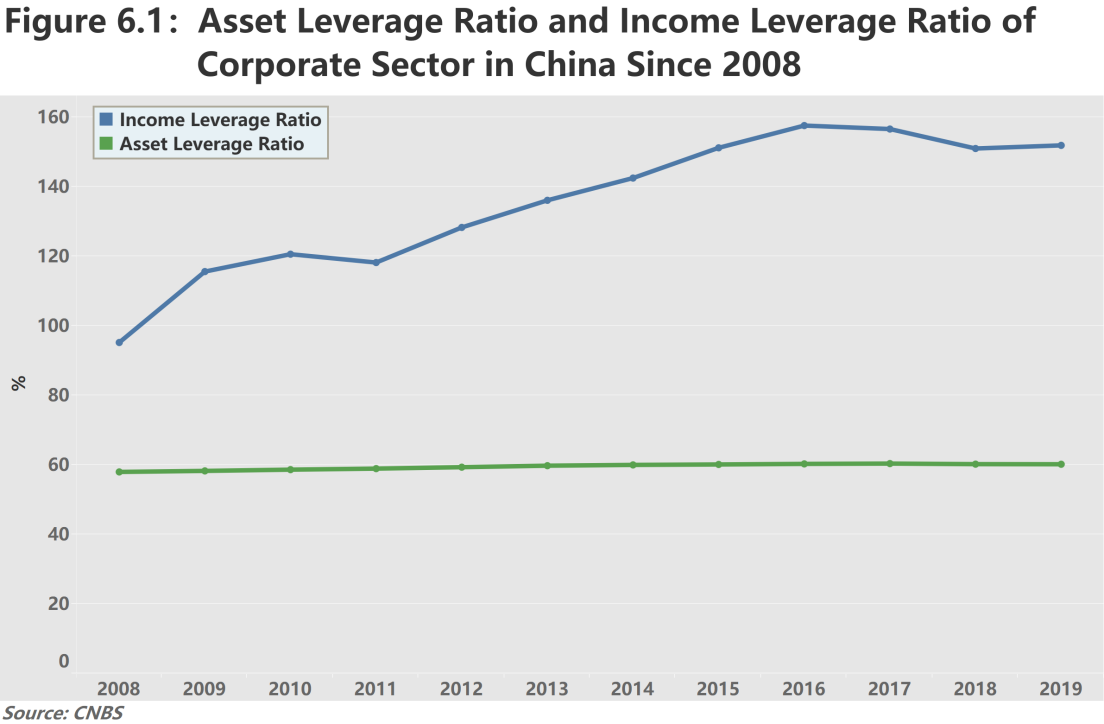

The report further analyzes the origins of the difference. The key is the sharp divergence between the income leverage ratio and the asset leverage ratio in the corporate sector: the former is very high but the latter is low according to international comparisons. The divergence between the corporate sector's income leverage and asset leverage ratios stems from the fact that the asset leverage ratio has basically maintained stability while the income leverage ratio has risen substantially and been volatile over the past decade.The resulting effect is that China’s corporate sector has seen a sharp rise of its income leverage ratio from 95% to 152%, which its asset leverage ratio stays very much stable around 60%. (see figure below). The reason for this is that the corporate sector’s debts are high relative to the size of GDP and thus leads to a high income leverage ratio, but small relative to its assets and hence makes the asset leverage ratio low, suggesting that high debts are backed by high assets. It is true that measuring the corporate debt level by the asset leverage ratio can also be problematic if the quality of high assets is low. Hence, rather than focusing on the debt size, it is better to care about asset quality.

The main conclusion of this report is that, combining the inferences drawn from the above two leverage ratios, the debt level of China's corporate sector, and in turn for the whole country, while having room for a reduction, should not be overestimated. The two secondary conclusions are that it is more reasonable to measure the corporate sector’s debt level by the asset leverage ratio rather than the income leverage ratio, and that rather than focusing on debt size, it is better to care about asset quality. The policy recommendations involve three aspects: firstly, "deleveraging" should not be done too quickly and fiscal and monetary policies should remain truly active and steady; secondly, a general survey of the quality of corporate assets should be conducted to ascertain the real non-performing assets ratio; thirdly, the high debt levels of state-owned enterprises, local government hidden debt projects and some overdeveloped sectors should be effectively reduced.

Please Find us: Twitter: RDCYINST YouTube: RealRDCY LinkedIn: 人大重阳RDCY Facebook: RDCYINST Instagram: rdcyinst

Key Words: China; debt; data; Liao Qun

京公网安备 11010802037854号

京公网安备 11010802037854号