Focus

Your Present Location: HOME> Focus-

Willism Jones: There's no doubt China will bounce back from epidemic's impact

There has been a great outpouring of sympathy for China throughout the world in the wake of the sudden outbreak of the novel coronavirus pneumonia. But, at the same time, those forces in the West who have been adamantly opposed to the admission of China into the pantheon of world powers, have seen this catastrophe as an opportunity to throw new obstacles in the path of China's rise.

2020-02-13 -

Zhao Minghao: Washington pressure tactics on Beijing are sure to boomerang

Chinese President Xi Jinping on Friday spoke on the phone with US President Donald Trump, sending the world a positive signal about the bilateral ties between China and the US. Trump expressed his confidence in China's economic growth, and said the US fully supports China's efforts to control the novel coronavirus pneumonia (NCP). The two leaders also reaffirmed their commitment to implementing the phase one trade deal reached between the two countries in January.

2020-02-12 -

William Jones: Pompeo takes his China-bashing to the National Governors Association

The U.S. Secretary of State deals primarily with issues of foreign policy, requiring a great deal of international travel, but Mike Pompeo is also spending quite a lot of time at home, with the particular goal of warning Americans about the "China threat." Pompeo's campaigning perhaps has other aims as well as he is no doubt considering his options post-Trump administration with his own ambitions at higher office.

2020-02-11 -

John Ross: Realism and clear-headed thinking a must in the coronavirus crisis

If the coronavirus is not contained it is a serious threat to the whole of humanity in every country. But so far the decisive actions of the Chinese government, which have been strongly praised by the World Health Organisation and other responsible international bodies, are containing that threat. The suffering in Hubei province is intense and tension is naturally great throughout China’s medical teams, who are the front line not only for their country but for humanity, battle to contain the virus. Not only China but the whole world is entirely depending on them.

2020-02-10 -

Zlatko Lagumdzija:A letter to China: After the rain, the sun comes up

My dear friends, colleagues, people of China, people who are suffering and struggling with coronavirus that is deadly menacing while lurking in the darkness.Your courage and patience, hard work and empathy, knowledge and wisdom is not only hope for saving your great nation but for the rest of the world as well. Today you are the first line of global defense of humanity under the grim shadow of the novel pandemic.There is a tide in the affairs of men. Which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures

2020-02-10 -

John Ross: Realism and clear-headed thinking a must in the coronavirus crisis

If the coronavirus is not contained it is a serious threat to the whole of humanity in every country. But so far the decisive actions of the Chinese government, which have been strongly praised by the World Health Organisation and other responsible international bodies, are containing that threat. The suffering in Hubei province is intense and tension is naturally great throughout China’s medical teams, who are the front line not only for their country but for humanity, battle to contain the virus. Not only China but the whole world is entirely depending on them.

2020-02-10 -

John Ross: Realism and clear-headed thinking a must in the coronavirus crisis

If the coronavirus is not contained it is a serious threat to the whole of humanity in every country. But so far the decisive actions of the Chinese government, which have been strongly praised by the World Health Organisation and other responsible international bodies, are containing that threat. The suffering in Hubei province is intense and tension is naturally great throughout China’s medical teams, who are the front line not only for their country but for humanity, battle to contain the virus. Not only China but the whole world is entirely depending on them.

2020-02-10 -

Helga Zepp-LaRouche: China deserves praise, cooperation in fight against coronavirus

To call any virus a "Chinese" virus is as silly as to say that it is someone's fault if he catches the flu or gets sick in general. It can happen anywhere in the world, and it can happen to every person on the planet. The lesson from this recent case of the reaction to the outbreak of the coronavirus is that it shows who in the international community is capable of responding to dangers that threaten all of humanity, and who is a troglodyte, and who is not.

2020-02-10 -

Ding Gang: Public awareness helps curb epidemic, rumors

"No public health gain is achieved without a battle." The recent outbreak of the novel coronavirus reminded me of these words of American M.D. Milton I. Roemer, which are printed on the back cover of a book I read several years ago - The Healthiest City: Milwaukee and the Politics of Health Reform, published in 1996.

2020-02-06 -

William Jones: The psy-war attitude towards China during the coronavirus crisis must cease

The outbreak of the coronavirus in Wuhan caught everyone by surprise. At the beginning of the Spring Festival holiday travel, the danger of a rapid spread was particularly dangerous. At the point it was discovered, the reaction of the government was swift and comprehensive, both with regard to prevention as well as detection. The Chinese government is following the development of the disease closely from the get-go and have taken extraordinary measures at the national level to deal with the crisis. All Spring Festival celebrations were canceled for the sake of people's health.

2020-02-05 -

Danilo Türk: Int'l cooperation against coronavirus is urgently needed

Now is a good time to remind the world leaders of the half-finished debates of the past two decades and of the need to strengthen the international cooperation for an adequate protection against the global spreading of infectious diseases.Peace is more than a mere absence of a global war. Peace requires much more and protection of lives against epidemics must be a priority. This is not a time for futile criticism of globalization, but rather a time for strengthened multilateral cooperation, which alone can secure a peaceful and a more prosperous world.

2020-02-05 -

Ding Gang: Why isn’t the BRI a strategy of China?

Western strategists have intentionally or unintentionally ignored the fact that China has not called the "Belt and Road" a strategy, but an initiative. One of the reasons is that the Belt and Road Initiative (BRI) is not China-centric, nor to create an alliance. BRI is a cooperative initiative targeted at development. It aims to build a platform to achieve joint development with other countries. China does not engage in building a closed circle excluding other countries.

2020-02-05 -

Ignoring WHO Praise, Pundits With ‘No Skills or Expertise’ Use Coronavirus to Attack China

Even though the Chinese government is taking great measures to contain the outbreak of the Wuhan coronavirus, Western media and so-called political pundits continue to criticize Beijing’s response to propagate their anti-China agenda, John Ross, senior fellow at the Chongyang Institute of Renmin University of China, told Sputnik Wednesday.

2020-02-04 -

Wang Wen: Chinese people have most positive outlook in a negative world

The spread of the novel coronavirus has brought an element of suffering to the 2020 Spring Festival. This has made the normally optimistic Chinese people more cautious about the future.

2020-02-04 -

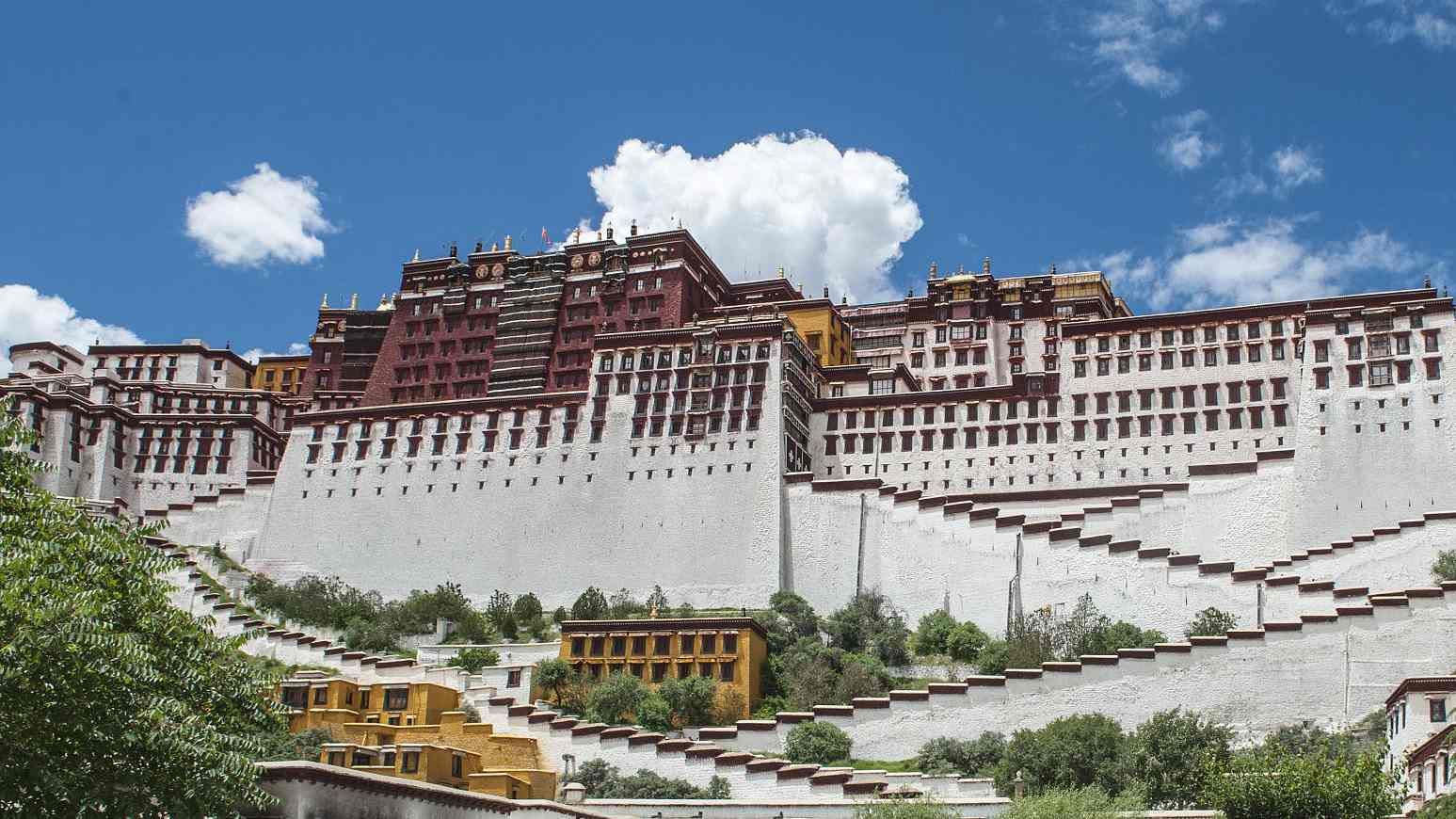

William Jones: U.S. Congress has no say in the future of Tibet

It's not the first time that Congress has shown an interest in the region. In 2002, Congress passed the Tibet Policy Act, which called for political discussions between China and the Dalai Lama who had spent an awful lot of time soft-soaping U.S. legislators on the issue.

2020-02-04 -

Zhao Minghao: U.S. continues to intensify tensions with China over technology

China and the United States have just signed the phase one trade agreement, a development widely applauded by the international community. The Managing Director of the International Monetary Fund, Kristalina Georgieva, said the agreement will reduce the uncertainty that has dampened global economic growth. The American business community also commented positively on the agreement, largely because they have paid a hefty price for the "trade war."

2020-01-21 -

Wang Wen: How can the US sell more goods to China?

Can China digest such a huge increase in imports from the US? I think the country has the potential, but it might be stuffed in the short term. It's like people who have a good appetite, but one might choke up if eating too fast. The key issue is, when such a situation occurs, it might impact the original process of structural adjustment in China's growth in social consumption. There will be fierce competition in Chinese markets among US products, other foreign merchandise and Chinese goods.

2020-01-21 -

Zhang Jingwei: China held its own in phase one trade deal?

A piece of good news has finally arrived as we usher in a new decade.On 15 January 2020 (EST), China and the US signed the Economic and Trade Agreement between the United States of America and the People’s Republic of China at Washington. This agreement is also widely known to observers and commentators as the “phase one” trade agreement between the two powers.

2020-01-21 -

Wang Peng: Confucius Institutes in Brazil and BRICS Education Cooperation

For the most part of the first decade in the 21st century, the five BRICS countries—Brazil, Russia, India, China, and South Africa —were among the fastest growing emerging markets. Certainly, the term, first coined as “BRIC” by Goldman Sachs in 2003, does not mean that these countries are a political alliance (like the European Union) or a formal trading association, though they have the potential to form a powerful economic bloc. Leaders from the BRICS countries regularly attend summits together and often act in concert with each other’s interests.

2020-01-20 -

Wang Peng: Confucius Institutes in Brazil and BRICS Education Cooperation

For the most part of the first decade in the 21st century, the five BRICS countries—Brazil, Russia, India, China, and South Africa —were among the fastest growing emerging markets. Certainly, the term, first coined as “BRIC” by Goldman Sachs in 2003, does not mean that these countries are a political alliance (like the European Union) or a formal trading association, though they have the potential to form a powerful economic bloc. Leaders from the BRICS countries regularly attend summits together and often act in concert with each other’s interests.

2020-01-20

京公网安备 11010802037854号

京公网安备 11010802037854号